A remarkable thing happened in U.S. politics last year. Raising the debt ceiling, a routine process that for decades had mostly been ignored outside Washington, D.C., became a source of nationwide contention. At the Cooperative Congressional Election Study, we examined public support for various proposals to substantially reduce government expenditures or increase revenues. The proposals included tax increases on the average American, tax increases on investments, and tax increases on the wealthiest, as well as cuts in Medicare, Medicaid, and defense spending, and restructuring Social Security and other programs.

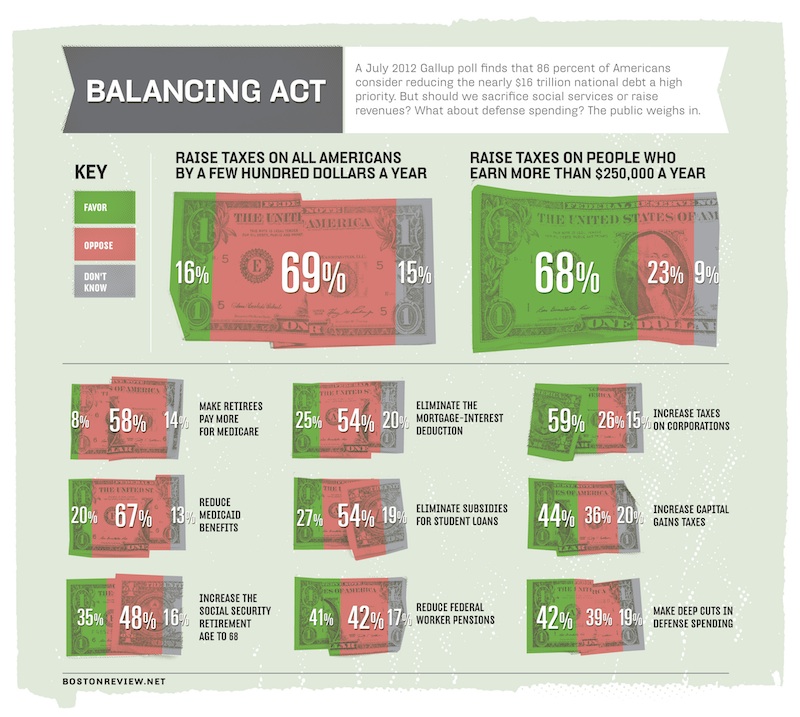

Though pretty much everyone wants the debt lowered, most of the schemes we studied are highly unpopular. Majorities of Americans reject broad tax increases and elimination of the mortgage interest deduction, a tax break for homeowners. Large majorities oppose cuts in Medicaid and increases in out-of-pocket Medicare costs. A plurality opposes increasing the Social Security retirement age to 68.

What do people favor? Large majorities support raising taxes on those who earn more than $250,000 a year and on corporations. A plurality would raise capital gains tax rates.

Not surprisingly, tax increases on those earning above the $250,000-per-year threshold and on corporations are central to President Obama’s reelection campaign. But such tax increases alone would not be enough. In order to bring the deficit down significantly, the winners of the 2012 elections for the presidency and Congress will be forced to make cuts and therefore face very unpopular choices. The survey data suggest that while the public is at best divided on serious cuts, the most popular targets will be the defense budget and federal employee pensions.