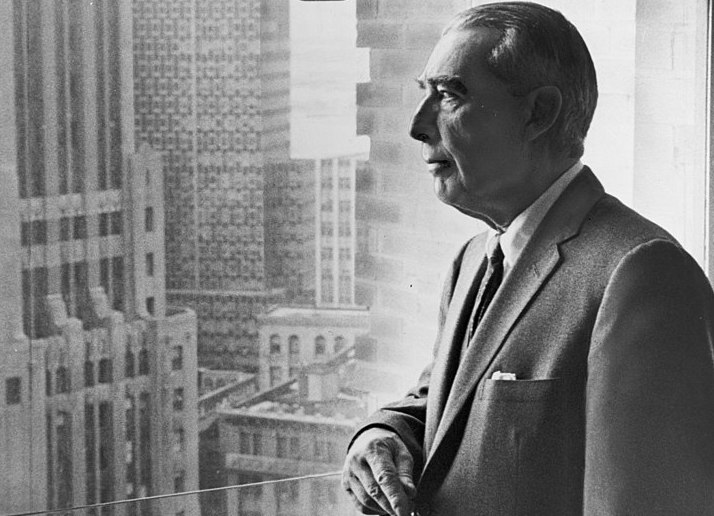

In 1962 the economist Milton Friedman published his landmark book, Capitalism and Freedom. In it, he argued for the policy framework we now call libertarian or neoliberal: free markets promote freedom, government intervention does not, and therefore government should be extremely limited. But the book was also crucial in advancing what is now known as the theory of shareholder primacy, the idea that corporations have no higher purpose than maximizing profits for their shareholders. “Few trends,” Friedman wrote, “could so thoroughly undermine the very foundation of our free society as the acceptance by corporate officials of a social responsibility other than to make as much money for their stockholders as possible.”

By 1970 he was expanding on this theory even more. Since markets are efficient, he argued, corporations should be constituted like markets; and since shareholders are the only stakeholders in the company who assume risk, the corporation’s purpose should be to generate returns for them. The messy and complex power dynamics of group interactions were thus written out of the story, and decision-making within corporations, Friedman and his acolytes argued, should focus on a singular goal, an “optimum”: maximizing shareholder value. “The key point,” he wrote in an essay for the New York Times Magazine, “is that, in his capacity as a corporate executive, the manager is the agent of the individuals who own the corporation . . . and his primary responsibility is to them.”

For the past fifty years virtually all business leaders, many policymakers, and a great deal of voters have accepted Friedman’s argument that shareholder primacy is the “natural” law of the market. Yet shareholder-focused corporations are not laws of nature, nor does that governance model accurately reflect today’s business dealings. This misguided focus is the result of decades of flawed theory in economics and law. It stems from an incorrect analysis of the relationships between shareholders, employees, management, and the corporation itself. And it is based on a flawed theory of the underlying economy: that markets work perfectly, and the heavy hand of government must get out of the way.

This ideology has caused immeasurable harm. The singular focus on stock price means that wealth is extracted by a small number of shareholders while those who work to produce that wealth are squeezed to the bone. Large corporations operating in this way so dominate U.S. political, economic, and social life that it is difficult for most of us to remember that the rules that shape corporate governance are democratically determined—that we, the electorate, can actually change them.

Who owns a corporation, after all? Friedman referred to the shareholders as the owners. According to this way of thinking, a business corporation is nothing but a collection of shares, so whoever owns the shares owns the corporation—and thus should be able to decide how to govern it.

In reality, however—as well as in law—corporations own themselves. Corporations are legal entities that require state government approval. Once incorporated, they have tremendous privileges to operate apart from the people who form them and run them: they have perpetual existence, limited liability, and the ability to take out debt in their own name. Corporations are different from other forms of businesses, such as sole proprietorships or LLCs, where there is no formal legal separation between the founders that profit from and run a business and the business itself. The very purpose of incorporating a business is to create an entity that lives on its own; it exists in perpetuity and is not just an extension of those who provide its capital.

Despite this fundamental separation, the delusion that shareholders are the exclusive owners of business corporations in the United States has persisted, causing most corporations to then govern themselves by the theory of shareholder primacy. But it does not have to be this way. New policies could ensure that all the stakeholders who collectively generate a corporation’s prosperity then benefit from its wealth.

Corporations have multiple stakeholders other than shareholders, including employees, customers, suppliers, and communities. In this essay, I will focus on one set of stakeholders—employees— because changes to corporate law to include employees as equals in corporate ownership and governance would be radically pragmatic. Employees could hold corporate equity shares in an employee ownership trust to more equitably distribute a corporation’s wealth. And employees could serve on corporate boards of directors alongside shareholders and management to ensure the corporation is governed both by those who take risks on its behalf and those who are affected most directly by its decisions.

These reforms, which should also include a new articulation of a corporation’s purpose and a change to corporate “fiduciary duty,” require procedural changes in how incorporation happens in the United States. The goal is not to pre-determine certain business outcomes—say, a set wage for workers or a set percentage of profits reinvested in the corporations—but to fundamentally rebalance power among three of the most important corporate stakeholders: employees, shareholders, and management. These changes would not automatically solve today’s economic problems, but they would stop us from hurtling down the path we are on—a path that sacrifices worker and community wellbeing at the altar of shareholder wealth maximization.

The idea that shareholders are the true “owners” of corporations dates back to Adolf Berle and Gardiner Means’s The Modern Corporation, published in 1932. Their conclusion, which is still the touchstone for theorists of corporate governance, was that the shareholder is like the captain at sea: others (i.e., management) plotted the course and steered the ship, but the captain put up the capital and knew why the ship was setting off and where it was going. In their words, the direction or purpose of the vessel was set by and could only be altered “by the persons having the underlying property interest.”

If shareholders are seen as the true owners of corporations, then the management must be forced, through carrot or stick, to maximize value for shareholders. Otherwise there is potential for managers to use corporate funds for their own personal benefit. The only way to solve “the separation of ownership from control” was to revest control in the hands of shareholders.

Despite Berle and Means’s theory, however, early- and mid- twentieth-century America was dominated by “managerialist” corporations such as General Electric and General Motors: large conglomerates with strong managers who prioritized stable growth and who bargained with powerful unions. Shareholders were passive, receiving steady dividends but exerting little authority within the firm.

Shareholder primacy as an economic and legal theory took off in the 1970s. Against the backdrop of economic stagnation and the rise of neoliberalism, economists such as Friedman refocused on the notion that corporations are just another kind of efficient market. The business corporation was thus seen as a collection of financial assets, and management was expected to have a financial background as opposed to an industrial background. Economists justified why shareholders should expect managers to squeeze as much value out of the firm for them as possible and argued that shareholders should no longer be content with steady dividends but should re-exert their role as “principals” who need to discipline the “agent” managers.

Academic economists built upon and formalized Friedman’s arguments throughout the 1970s, forming what continues to be the mainstream economic analysis of the corporation today. Crucially, much of this analysis moved beyond the earlier idea from Berle and Means that shareholders were owners. Shareholders no longer exercised the responsibilities that usually accompany ownership rights, so instead, this new cohort of economists extended Friedman’s claims about market efficiency to the specific institution of the corporation and argued that a corporation is nothing but a “nexus of contracts.” In other words, the firm is not an independent organization but rather a marketplace where different contracts are freely made. As Armen Alchian and Harold Demsetz put it in 1972, “the firm . . . has no power of fiat, no authority, no disciplinary action any different in the slightest degree from ordinary market contracting between two people.”

This conception led to the key argument in favor of shareholder primacy: shareholders have a distinctive relationship to the corporation. All other stakeholders have “complete contracts”—employment contracts or contracts for a fixed return on a bond. Shareholders, in contrast, have an incomplete contractual relationship with the corporation because no dividend or capital gains are guaranteed. Since they do not have a fixed contract, shareholders must have control rights or else they will not put capital into the corporation.

The corporation was thus bleached of organizational politics and power. The move replaced the corporation as a site of contribution by many stakeholders—where contributions of and gains to each group are subject to disagreement, negotiation, and power struggles—with a market-based view. Turning the corporation into a kind of market means, as Michael C. Jensen and William H. Meckling wrote in 1976, that “conflicting objectives of individuals are brought into equilibrium within a framework of contractual relations.” In other words, if corporations are just a nexus of contracts, then all relations among corporate stakeholders are determined purely and efficiently by market forces, and their interests are “protected by contractual and regulatory means rather than through participation in corporate governance.” Notably, employees should be content with the wage determined for them by the invisible hand of the market.

Moreover, because shareholder interests are primary, shareholders should govern the corporation in order to discipline management into serving their interests. This conclusion, called “agency theory,” holds that agents (managers) do not automatically do what the principal wants. A manager may be content to let wages rise to avoid strife in the workplace, since his financial remuneration is not affected by higher costs. What matters to managers is only their share in the wealth reduction—not all of the wealth lost. It is the shareholders who lose out as employee costs rise which is why shareholders must monitor managers’ behavior and induce them through various mechanisms (sufficient motivation or fear of repercussion) to align their interests with that of their principals.

Neglecting organizational realities, however, leads shareholder primacy into two major mistakes: it ignores how corporations produce and innovate, and it sees shareholders as the sole risk-bearers when, in fact, they are often protected and very removed.

First, as William Lazonick’s Theory of the Innovative Enterprise (2013) explains, shareholder primacy lacks a theory for how corporations actually develop new ideas for products, new marketing strategies, and new means of using resources. Innovation depends on financial resources, but it crucially also involves “strategic control and organizational integration” in social conditions that are “uncertain, collective and cumulative” in character. Put simply, successful corporations are human organizations that depend on the risky, longterm, creative collaboration of different kinds of participants. This is obvious to anyone in the business world but absent from a “nexus of contracts” view of the corporation. Investors buying and selling shares with each other in diversified portfolios are not walking the shop floor. They aren’t surveying customers to iterate successful products or competing with coworkers for the highest sales.

The second mistake is to see shareholders as the sole risk-takers, or even to see them as contributing to the corporation directly at all. When Berle and Means wrote their book, the bulk of corporate growth came from new issuances of stock, which, they said, kept management accountable to suppliers of capital since they depended on capital for future growth. But none of this makes any sense in current capital markets.

Most shareholders today, after all, are traders, not initial investors in a company’s initial public offering (IPO). These traders—all of us holding corporate stock in a retirement portfolio, for example—do not think of themselves as “owners” since they are not contributing directly to the corporation’s capital. The fact that our ownership is mediated through a very long chain of financial investors, whose interest is often to earn fees through trading volume rather than sustainable growth of corporate wealth, means that retail shareholders are even further cut off from business decisions.

Today there are only two types of shareholders with real power. First, minority shareholder “activists,” who have leveraged the massive holdings of institutional investors to exercise actual power over boards and corporations. And, second, the private equity funds that take over companies to extract wealth regardless of the impact on future productivity—the opposite of what an owner is supposed to do. Notwithstanding these two groups, retail shareholders—you and I invested through our 401(k) or mutual fund—do not actually exercise control over corporations.

Moreover, the claim that shareholders assume the most risk lumps together diversifiable and undiversifiable risk. Shareholders of large public corporations today are not generally taking a risk on the profitability of a given firm. Instead, they are diversified investors who scarcely notice the particular rising or falling share price of a given company, because they have reduced their risk by holding a broad cross-section of the market. Of course, they still take a risk that the entire market will fall (as happened in 2009) and that they will not be able to sell their investment when they need to. But concluding that their risk is different in kind from the risk an employee or bond holder takes no longer makes sense. As even Berle and Means noted, security holders “may be regarded as a hierarchy of individuals, all of whom have supplied capital to the enterprise, and all of whom expect return from it.”

Workers, by contrast, contribute more to creating corporate wealth and longterm productivity than a person whose share has already been traded 10 or 10,000 times. And their deep investment in the corporation is not diversified—their risk and rewards depend entirely on the profitability of the corporation. If a corporation’s profits plunge and layoffs follow, workers face the tremendous hurdles of finding new employment, relocating, or collecting scant unemployment.

The current model of shareholder primacy is simply not a reflection of today’s reality. It treats labor as a cost to be contained while a true reckoning with how corporations operate reveals the significant risks that workers take on as well as their contributions to organizational success. Transitioning to a stakeholder model for corporations—specifically, employee governance and employee ownership funds—makes better sense of employee contributions while also mitigating some of the worst outcomes of the obsession with a constantly rising share price.

I referred earlier to implementation of the employee governance model as “radically pragmatic” because some straightforward, politically obvious changes could have a huge effect on economic inequality. In the United States, corporate law is state law: incorporation is accomplished at the state level, and the “internal affairs doctrine” allows corporations to choose a state for incorporation that is not otherwise tied to their business activities and to have their corporate internal affairs governed by that state’s rules. Practically, this has meant that Delaware has become the state of choice for large corporations, due to its historical offerings of very business-friendly corporate law. Reforming corporate law at the state level would thus be politically very difficult since it would all unravel if one state sticks with shareholder primacy.

Three federal reforms would get around this hurdle. First, and most crucially, Congress can mandate that large corporations (say, those over $1 billion in annual revenue) be required to charter federally. This change—which is the threshold for Elizabeth Warren’s bill, the Accountable Capitalism Act—would ensure the remaining reforms would be enacted, including number two: a redefinition of “fiduciary duties.” By redefining a board’s fiduciary duties to include more than just shareholders, the board of directors would be accountable to more stakeholders. This change might seem weak since it would not prescribe a certain outcome for the various stakeholders, nor would it specify how boards should balance the different interests of stakeholders. Still, it would make the decision to pay out billions in stock buybacks while firing employees a lot more difficult for boards to justify. Currently, corporate boards engage in this behavior and then hide behind the excuse that their only responsibility is to shareholders.

More positively, this reform would encourage corporations to form boards made up of individuals from multiple stakeholder groups—including employees—in order to weigh the impacts of major corporate decisions on all groups at the table. The board is the ultimate decision-making authority, after all: hiring and firing the chief executive, making major financial decisions, and bearing legal responsibility for the affairs of the corporation. Employees should have a say in these matters. Proposals vary about how best to include employees on boards, but it should be obvious that “token” employee representation is not sufficient: the point is to ensure that employees have a meaningful voice in corporate decisions. This is crucial since courts adjudicate board decisions using the business judgment rule—meaning that, in the absence of fraud or malfeasance, judges do not rule on the substance of decisions, they simply look to see if the board followed proper procedures. In other words, if fiduciary duty was redefined, boards would have to show evidence that they have taken the interests of multiple groups of stakeholders into account.

Finally, corporate purpose statements, which are filed as part of the charter at the time of incorporation, should include a requirement of positive social benefit. Benefit corporations such as Patagonia and Kickstarter already adhere to this standard, vowing to create “general public benefit,” which is defined as a “material positive impact on society and the environment, taken as a whole.” Currently, corporate purpose statements simply require that companies stay within the bounds of the law. If implemented, the public benefit standard would be incredibly difficult to judge at such a high level of abstraction, but it could be a way to force companies to reckon with egregious pollution or community harm.

Once we change corporate governance to be more democratic and reflective of the realities of contributions and risks, the other major area for policy reform is to grant employees shares of corporate equity in a collective trust, or “employee ownership.”

At its most basic level, employee ownership creates a right to a share of the profits when businesses do well. Less tangibly, employee ownership also gives workers the ability to vote for the company’s board of directors and other major decisions that the company’s external shareholders traditionally make. Holding equity in an employee trust means that employees are automatically granted their share when they start working for a corporation—they are not risking their own funds to buy shares as an individual.

This would make corporate ownership and governance far more reflective of society. In 2018 the top 10 percent of households owned 86.5 percent of corporate equities, while the bottom 50 percent owned 0.8 percent. New data from the Federal Reserve’s Distributional Financial Accounts shows that the trend has gotten steadily worse for the last thirty years. The rates of Black and Latinx families owning significant shares has been thirty percentage points lower than white families for decades. In a company such as Walmart, a few lucky descendants of Sam Walton own over half of the company’s shares. Including workers in ownership and governance is necessary to lessen the hold on corporate wealth by affluent white families.

Decades of neoliberal thinking have obfuscated the basic logic that all those who contribute to the success of a corporation should see just rewards. There are signs, however, that this logic is changing. In September 2018 the UK Labour Party proposed a policy for “Inclusive Ownership Funds,” which would require corporations with over 250 employees to ensure that employees receive dividends.

The Labour Party’s plan is detailed. It ensures that investors are not injured by having their share value diluted because it institutes a transition process: every year, employees gain a 1 percent ownership stake, up to a cap of 10 percent. Once funds are in a trust, then the shares are not available to be resold. This is crucial: the stakes are not a private, freely transferable wealth asset, and since employees don’t purchase stakes, they can’t sell them when they leave employment. Rather, by becoming an employee of the corporation, you receive an ownership stake in the employee collective trust—a stake that remains in the trust if you move to a different job. So long as you are an employee, though, that stake grants you governance rights and the right to receive a share of the profits.

The proposal has reignited energy in the United States around shared ownership of large corporations. The presidential campaigns of Bernie Sanders, Elizabeth Warren, and Kirsten Gillibrand, for example, have all supported versions of the idea. And employee ownership, in a variety of forms, is broader in the United States than many might think. In knowledge economy sectors where startups are common, many companies incentivize employees to join a fledgling startup with the promise of a big payout down the road, granting equity rather than cash to start. In manufacturing and some service sectors, ownership is more commonly found in the form of a retirement plan, called an ESOP, in which employees are granted stock that is held in trust, and which functions as a form of retirement savings. There is also a growing movement of worker cooperatives and employee-owned businesses among small and medium sized businesses.

But broad-based employee ownership, meaning share ownership beyond the top executives, is concentrated in certain sectors and certain kinds of plans—the majority of which don’t cover the large portion of the U.S. workforce that labors at or near the minimum wage. Hospital orderlies, fast-food workers, retail clerks—these workers generally only get a paycheck, and they haven’t seen a real pay raise in decades. Moreover, because workers of color are concentrated in lower-paid employment through racial stratification, they are less likely to have income to purchase shares on their own.

If we want to transform the inequalities at the heart of our economy, we must address the corporations where the majority of Americans work. Less than 1 percent of U.S. businesses employ over 50 percent of the workforce. These are the most profitable corporations as well—and, unsurprisingly, the ones who prioritize payments to their shareholders over increasing the wages of their workforce. Meanwhile, CEO “equity-based compensation”—which links CEO compensation to shareholder value—has risen dramatically as a way to ensure management keeps shareholder reward as its north star. In 2017 CEO-to-median worker pay was 312-to-1 and has risen since then as the stock market has climbed.

I would argue that an American “Inclusive Ownership Fund” should be mandatory only for the tiny number of corporations that exert outsize power in the U.S. economy. By my estimate, there are approximately 1,500 corporations with publicly-traded shares that have both an annual revenue over $1 billion and over 1,000 employees. Some of these are household names—such as Walmart or McDonald’s—but plenty are the kinds of large corporations that operate in the background of the economy and primarily provide services to other large corporations.

Mandatory employee ownership would also allow these employees to directly engage in the governance of the corporation by participating in the big decisions that determine their futures. Under U.S. law, negotiations between labor unions and corporate management cannot touch on business decisions; instead, discussion is limited to the terms and conditions of employment. This arrangement has locked U.S. workers out of collaborative participation in improving business productivity. By engaging as owners of shares, employees will have the same rights to weigh in as investors do today: in mergers and acquisitions, liquidation, and electing the board of directors.

While some elements of a U.S plan should differ from the U.K. version—including the employee threshold for requiring such a plan, or whether some portion of dividends should go to a public fund—the core idea of recognizing workers as co-equal stakeholders to outside investors bears just as much promise here. It remains the obvious way to rebalance wealth by granting employees a share of the wealth they create, and it could begin the process of reversing decades of wealth extraction by shareholders. We cannot solve economic inequality through wage increases alone: the gaps in wealth are too large.

Of course, corporate boards are not going to benevolently share ownership or privileges with employees on their own. Any such massive change must be driven by public policy. But remember that corporations are creatures of public permission. This means that we—the public—can choose the rules that govern how corporations interact with their stakeholders. Indeed, even Friedman himself saw democratic government playing this role: “government,” he wrote in Capitalism and Freedom, “is essential both as a forum for determining the ‘rules of the game’ and as an umpire to interpret and enforce the rules decided on.”

Today’s rules are broken. Restructuring corporations with employee ownership and governance rights would represent a sharp break from decades of neoliberal policymaking, but we cannot tweak our way out of the mess of deeply-rooted economic inequality. These reforms may not be a silver bullet, but they would ensure the basic standard that employees do well when businesses do well. If corporate executives and shareholders cannot see themselves sharing ownership and governance with employees, perhaps they should try creating value without employees and see how far they get.