The proximate cause of the financial crisis that has now engulfed the world and led to serious recession in the United States was the bursting of the housing bubble. But the true cause was the anti-government ideology that developed in the 1970s, solidified during the Reagan presidency, and was carried to extremes in recent years by Republicans and, to a significant degree, by Democrats as well. The nation’s economic and political health now depend not on substituting an old ideology for a new one, but on freedom from these ideological restraints and on the pragmatic, robust use of government.

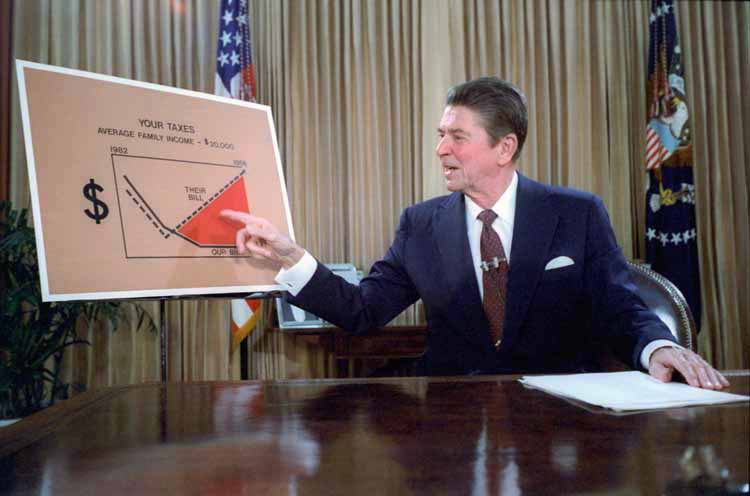

Ronald Reagan and Milton Friedman are the founding fathers of the entrenched ideology of the past generation. Their heirs spout the dogma as if their claims are beyond question. The actor and presidential contender Fred Thompson summed it up with a Wall Street Journal piece early in 2007 headlined, “Closed case: tax cuts mean growth.”

Professor Dick Armey, a mainstay of the House for years and former majority leader, claimed that those who did not agree with his passion for tax cuts and small government were afraid of “big thoughts.” Those big thoughts were the ideas of his hero Friedman.

Worse are those who say anything they like about American history, untainted by study of it. “The greatness of America has never been in its government,” said Mike Huckabee, who was for a few months a serious presidential contender. “Any time government gives something to us, they take something away.”

The Democrats have long since eagerly clambered aboard. By the 1990s, conventional wisdom among Republicans and Democrats alike held that high tax rates were destructive and that big government, including those tentacular regulations, ate away at the nation’s prosperity. In his 1996 State of the Union Address, Bill Clinton proudly announced, “The era of big government is over.” Running for reelection that year, Clinton went on to sign legislation ending the Depression-era separation of commercial and investment banks. His financial appointees, according to reports in The New York Times, kept Washington from regulating the financial derivatives that are at the core of current credit crisis.

The Republicans have been worse. In 2004, while subprime lending was heating up, the Securities and Exchange Commission allowed investment firms to borrow as much as they liked without formal government restriction. The government retained the right to take a look at the books, but didn’t really bother. Now, SEC Chairman Christopher Cox, in a concession to reality, says voluntary self-regulation failed.

In truth, both de facto and outright financial deregulation have long been underway. The real leader of the anti-government revolution, as we are all now aware, was Alan Greenspan, former chairman of the Federal Reserve. Even after the bailout of Long-Term Capital Management in 1998, he pressed for eliminating oversight of hedge funds and advocated against new disclosure requirements. A free-market economist should aggressively seek market transparency. Not Greenspan. He disdained the efforts of government officials to anticipate investment bubbles and oversee methods by which investment firms invested in securities or leant to clients. They know their markets better than we, he would say. The Clinton team was mostly on his side.

And the spirit of ideology persisted in the presidential campaign. Even Barack Obama did not dare propose a tax increase on the rich without offering almost everyone else a tax cut. The last thing America needs is a tax cut. The agenda for the future—for our own good—is much too long to sacrifice more tax revenues.

We need not take on the economic theories of Milton Friedman and his disciples to make a case for government. Even Friedman acknowledged that free markets do not adequately supply some public goods, like primary education and roads. The benefits of such investment are spread across society; no one business or individual will invest enough. And there are other strong theoretical arguments to be made for state intervention in areas of information economics, behavioral economics, agency problems (who really runs corporations), and institutional economics and the power of the firm.

However, it is possible to look at the question of regulation empirically rather than theoretically. One useful area is cross-country analysis, whereby economists look at how countries with bigger governments and higher taxes fare. In recent years, Peter H. Lindert, a leading economic historian from the University of California, Davis, has comprehensively analyzed the literature. One argument against government is that public spending is unproductive and crowds out private spending. But, time and again, he found that studies claiming that high taxes reduce economic growth simply did not hold up.

“It is well-known that higher taxes and social transfers reduce productivity. Well-known—but unsupported by statistics and history.”

Lindert’s exhaustive statistical analyses were based on eighteen countries over ninety years. No matter how he juggled the data, he found no relationship between the growth of GDP per capita and productivity and the level of taxes or the extent of social spending. There is a dramatic “conflict between intuition and evidence,” he writes. “It is well-known that higher taxes and social transfers reduce productivity. Well-known—but unsupported by statistics and history.” And he goes on: “Neither simple raw correlations nor a careful weighing of the apparent sources of growth shows any clearly negative net effect of all that redistribution.”

These days we all know how easily statistical analyses can be rigged. But if the case against big government were open and shut, then there would not even be a debate among economists. As Lindert notes, if a dollar of social spending reduces GDP by, say, sixty cents, then why are so many European nations doing well? They spend 25 to 35 percent of their national income on the poor, the elderly, the sick, and the unemployed, which therefore means, according to anti-government economists, they must have reduced their GDP by 15 to 20 percent. In other words, if they simply eliminated this spending, they would all be as rich or much richer than the United States, even as their people work many fewer hours.

Other economists have done research similar to Lindert’s. They have shown that one of the other anti-tax arguments—that it significantly reduces incentives to invest and work—is highly exaggerated. Consider that the United States adopted an income tax in 1912, raised it periodically over the next fifty years, and grew much faster on average than it did in the income tax–free 1800s.

Then there is the argument that government is always inefficient. Sometimes it surely is. But Medicare’s administrative expenses consume only 2 or 3 percent of outlays compared to 15 to 20 percent for private medical insurance. The administrative expenses of Social Security, a marvel of efficiency, are miniscule.

Indeed, the economic history of the United States is one of consistent and vigorous government action, a fact that lawmakers like Huckabee either don’t know or willfully ignore. Even when government expenditures were low, government established regulations that seriously affected the nation. Thomas Jefferson was one of the early regulators of land-distribution policies, which were radical by any standard we know today in America. As a consequence, land was widely distributed at a fair price in the nation early on, and speculators (to the degree possible) kept at bay.

State and local government spent on public improvements aggressively in the early 1800s, building canals and roads. By 1850 the United States had one of the the world’s great free primary education systems. Through land donations—a form of spending—the federal government supported the new agricultural and technical colleges, such as MIT and the University of California, Berkeley, and invested heavily in railroads. In the late 1800s and early 1900s, government built the sanitation, water, and sewer systems that made urban life possible. In the 1900s, government built the new high schools necessary for an advancing economy, along with new roads, dams, bridges, and all manner of public works. Look at your own city. After World War II, the federal government built the national highway system, subsidized college for GIs, supplied the polio vaccine, developed the Internet—and on.

That is where tax dollars go. The reason higher-tax nations do well economically is that government spending can and often does succor economic growth. All rich nations today have robust government.

There is little reason to believe that during periods of growth government was holding the country back. One set of empirical data makes this clear: the failures of the U.S. economy since the new ideology became entrenched in the late 1970s. Wages have hardly grown and the financial community has run amok. The American Society of Civil Engineers graded the nation’s infrastructure a “D.” The penetration of broadband in the United States falls well behind that in other nations, partly because its costs are held high by monopolies. The costs of the healthcare system soar, while more people are left uninsured and thrown at the mercy of the public hospitals. College tuition rises out of sight.

We should not oversimplify the case. In the same years, America has enjoyed a high-tech revolution and stunning health care advances. Productivity started to grow rapidly again.

Still, much of this could have been achieved without the many failures listed above, in particular, the wage crisis. Male incomes at the median are below levels of thirty years ago, after inflation. In large part, Americans borrow not to live the good life, but to make ends meet. Such borrowing enabled the growth of the irresponsible financial industry.

America’s to-do list is now very long. The nation is encumbered by debt, and many, with an unnecessary fear of budget deficits, believe it cannot do what it must. The first step will be to jettison ideology and return to America’s pragmatic roots. That has not happened yet, but push-back has already started: ideologues blame Fannie Mae for virtually the entire credit crisis—a contention nothing short of preposterous.

There are signs that the new president is a practical man who makes judgments based on evidence, not dogma, liberal or conservative. He is open to serious new policies and he is genuinely caring. Caring is not merely the path to justice, it is often the path to prosperity.