Welfare for Markets: A Global History of Basic Income

Anton Jäger and Daniel Zamora Vargas

University of Chicago Press, $32.50 (cloth)

When the CARES Act slated $1,200 “economic impact payments” for most American adults in the early throes of the pandemic, advocates of universal basic income (UBI) could be forgiven for imagining that their long-cherished ideal at last might become reality. For proponents of the idea—a regular, unconditional cash transfer from the state—the times were uniquely propitious: two more impact payments followed in 2020 and 2021, and the American Rescue Plan further increased cash transfers through significant expansions of unemployment benefits as well as child, dependent care, and earned income tax credits.

Dreams of a guaranteed income are longstanding, but they leapt back into the public imagination in the wake of the dismal recovery from the 2008 financial crash, endorsed by a diverse array of figures on both the left and right. In 2020 presidential candidate Andrew Yang briefly managed to catapult himself into the media spotlight by pitching an eye-catching “Freedom Dividend” of $1,000 a month to every U.S. citizen over the age of eighteen. Building on this momentum, the massive social and economic dislocation of the pandemic and the nearly unprecedented use of fiscal firepower seemed poised to effect a permanent transformation of the welfare system in both the United States and across much of the Global North.

Yet as soon as the drastic recovery measures began to revive the U.S. growth engine and inflation began to tick upward as snarled supply chains creaked under new waves of consumer demand, a chorus of economists and employers began to scream that the emergency measures were responsible for overheating the economy. Today inflation anxiety continues to dominate headlines, the impact payments have entirely stopped, and every pandemic-era expansion of the transfer system has been allowed to quietly expire. With the end of the expanded child tax credit, 3.7 million more children plunged below the poverty line, and food insufficiency for families with children has increased by 25 percent. Basic income seems as far from reality as it ever has been.

Given its frequent selling point as a “utopia for pragmatists”—one endorsed by Yanis Varoufakis, Charles Murray, and Mark Zuckerberg alike—why is basic income always on the cusp of implementation, a dream perpetually deferred? This is the question that Anton Jäger and Daniel Zamora Vargas can never quite answer in their new book, Welfare for Markets: A Global History of Basic Income, an illuminating history of intellectual arguments for basic income whose significance is nonetheless circumscribed by its narrow frame. Though Jäger and Zamora call their project a “social history of ideas,” their singular focus on basic income—and their doubt that it can possibly pose a challenge to the hegemony of the market—can make UBI seem both natural and inevitable, a virtual fait accompli. On this reading, even left-wing UBI advocates are unwitting dupes whose political imagination has been warped and depleted by decades of market ideology.

The broader social and political history lurking in the margins of the book’s frame points to a different conclusion: that a basic income has been sufficiently threatening to work incentives—and thus to the very heart of the liberal capitalist order—to be ceaselessly beaten back, even after only modest inroads and in the face of support from an ideologically promiscuous set of elites. Far from spelling the end of meaningful politics, basic income is one site where it can and has flourished—and where the hidden structures underlying our economic life have often been laid bare.

Jäger and Zamora, both Belgian, are historians of modern political thought. Jäger focuses on American populism and Zamora on the European welfare state, yet their multifarious and cosmopolitan interests make them particularly attuned to the transnational traffic of ideas and political technologies and to the strange light in which the American or European political terrain suddenly appears from the vantage of the other shore. In their prolific writing, both individually and in collaboration, this distinctive standpoint gives their work its refreshing—if occasionally maddening—transversal quality.

Zamora’s puckishly framed The Last Man Takes LSD: Foucault and the End of the Revolution (2021), co-written with Mitchell Dean, ruffled feathers by exploring what it took to be Michael Foucault’s alleged late career dalliance with the libertarian undercurrents of neoliberal and Californian thinking. For all its intentional provocation and occasional lapses into lurid guilt by association, the book was also grounded in a fine-grained knowledge of Foucault’s relationship to the institutional and personal intricacies of the French left of the late 1970s and early 1980s—a context about which even many serious Foucault scholars in the United States have paid little attention. Nor should it come entirely as a surprise that Jäger and Zamora edited the recently published No Politics but Class Politics (2023), a volume of essays by and interviews with political scientist Adolph Reed and literary scholar Walter Benn Michaels, the most prominent American advocates of the hard-line position that a liberal focus on racial disparity has obscured more foundational issues of class inequality and power in U.S. politics. This “anti-identitarian” ethos, clustered around magazines like nonsite and Damage, seems ripe to appeal to a western European context that has historically understood itself (rightly or wrongly) to be less strongly defined by the legacy of the color line.

It is precisely this wide-ranging approach that Jäger and Zamora bring to bear in Welfare for Markets, which covers developments across the globe—United States, Britain, France, Belgium, the Netherlands, South Africa, India, Mexico, and beyond—while deftly weaving together English, French, and Dutch sources. Though meticulously researched, Welfare for Markets is a slim volume of succinct and lucid argumentation. Elsewhere the authors have made it emphatically clear they view UBI schemes as undesirable, unworkable, and even pernicious. As they see it, such ideas are driven by a postwork imaginary (hatched by radicals “plucked . . . from the entrails of the student milieu”) that has ceded the realm of production as a zone of politicization. Basic income proposals are further stained, Jäger and Zamora argue, by an “anti-normative instinct” (epitomized by Foucault himself) that germinated dangerously in the New Left, which accepts “a highly individualist notion of ‘needs,’ in many ways compatible with the ‘consumer sovereignty’ trumpeted by neoliberals.” Besides the book’s title, this polemical message has been carefully stripped away from the book, leaving an account of largely intellectual history in a more sober academic mode. Their aim, as they put it, is not merely to explore the origin of the idea of basic income itself but to use it as a “prism” through we can “observe evolving conceptions of economic justice, social rights, the state, markets, and political organization tout court.”

This endeavor begins with what Jäger and Zamora call an “anti-mythology.” Present-day basic income advocates, eager to project a long and noble lineage for the idea, point to figures such as Englishmen Thomas More and Thomas Paine and French socialist Charles Fourier as illustrious ancestors in a well-defined tradition. Welfare for Markets convincingly demonstrates that this genealogy is a mistake: the diverse past pronouncements that have been retrospectively knitted together into a single thread bear little resemblance to contemporary versions, either in substance or in context.

The long shadow of classical republicanism in European political thought, with its concern for propertied self-sufficiency—usually realized through land—as a requisite for liberty from arbitrary domination, is particularly relevant for understanding the early modern context. The consensus view of post-Renaissance thinkers was that Roman agrarian laws, which had sought to redistribute landed holdings, had led to the ruin of the republic. The fallout motivated a search for other means of individual self-sufficiency which would avoid such radical measures. This anxiety animated More’s recommendation, in Utopia (1516), “to provide everyone with some means of livelihood”—a form of in-kind provision intended as an alternative to the Roman example. The same fear motivated Paine’s proposal, in Agrarian Justice Opposed to Agrarian Law (1796), for a “National Fund” to be “paid to every person.” This was not, for Paine, a radical act of leveling but “a compensation in part, for the loss of his or her natural inheritance, by the introduction of the system of landed property.” Rather than the total abolition of property advocated by the radical wing of the French revolution, in other words, Paine proposed a one-off payment to enable the poor to at least to “buy a cow, and implements to cultivate a few acres of land” so as to prevent their becoming a public burden. Even when Fourier broke with such anxieties in the early nineteenth century, his proposal for a “decent minimum” for living in his “Letter to the High Judge” (1803) was implicitly to be paid in kind, since his imagined utopia was to be free of money altogether.

Such in-kind compromise schemes, however, were a far cry from the continuous and unconditional payments envisioned in modern basic income proposals. Rather, as historian Peter Sloman has shown, the roots of this latter idea principally lie in proposals for a “state bonus” or “social dividend” in the Fabian circles of interwar Britain, which were keen to use the transfer apparatus of the state as a social palliative (though they were quick to avoid undermining incentives to work). Although Jäger and Zamora touch on this early history, for them the modern history of basic income really begins with the negative income tax (NIT), first formulated by none other than Milton Friedman during his stint at the Division of Tax Research of the U.S. Treasury in 1941–43. In a chapter that serves as the intellectual centerpiece of the book, the authors narrate Friedman’s origins as a consummate New Deal technician—long before his latter-day notoriety as an aggressive popularizer of free market policies—who spent the 1930s at the National Resources Committee and the National Bureau of Economic Research before landing at the Treasury.

The seeds of Friedman’s later market radicalism were already present in the NIT concept itself, which turned the emerging consensus of the welfare state on its head. The prevailing wisdom that characterized the New Deal—and sill more the welfare state famously advocated by the 1942 Beveridge Report in Britain—endorsed state-organized restructuring of markets and often the direct provisioning of goods like housing, employment, or health care. Yet rather than tackling poverty and inadequate employment through the alphabet soup of agencies and programs that had mushroomed in the New Deal period, Friedman asked, why not simply enact “negative” rates within the federal income tax system, ensuring a minimal floor of income for all individuals below a given threshold?

This proposal would have been unthinkable only a few years prior. The fiscal firepower needed to fight World War II had only recently driven a massive expansion of the federal income tax, which came to cover a majority of the population for the first time in U.S. history. Yet the logic of the NIT was also partly inspired by Friedman’s work in the bowels of the administrative state in the late 1930s. Given the newly vital role of “standard of living” estimates for guiding New Deal policy, Friedman had been tasked with constructing adequate consumption indices from nationwide survey data—a process requiring headache-inducing and ultimately arbitrary determinations of which goods counted as necessary purchases. A far simpler solution, Friedman came to believe, was simply to use cash transfers to set a minimum standard that individuals could spend as they saw fit.

Put so simply, the idea has a certain intuitive appeal. Yet Friedman’s proposal dovetailed felicitously with several key intellectual developments of the period. The economics profession of the interwar period had been deeply shaped by the “socialist calculation debate” over the possibility of a directly planned economy that erupted in the wake of World War I. In their defense of a free market price system, many economists began to stress its unique capabilities of coordination and efficiency. The field moved to increasingly hardline opposition to collective or state-led determination of needs: instead, welfare—in the sense of preference satisfaction—would have to emerge spontaneously from the aggregated choices of individual consumers. Many maintained that the radical incommensurability of individual desires gave economics no scientific basis on which to advocate income redistribution. By the late 1930s these propositions had become axiomatic for the Anglo-American “neoclassical” mainstream, so much so that even left-leaning economists in this period began to endorse the ultimate efficiency of the price system. Socialist planners, economists such as Oskar Lange and Abba Lerner suggested, should merely build in targets and objectives into prices, and then leave the clearing and equilibrating processes of the market well enough alone.

Within this paradigm, the NIT had the advantage that it could ameliorate the worst excesses of market society—ensuring a basic income floor—without interfering with individual consumer choice or the maximally efficient allocation of the market as a whole. Quite unlike the logic of the New Deal or the welfare state, it left the price system untouched. Crucially and radically, too, unlike conventional forms of social security or earlier transfer proposals, the NIT was designed as an “antipaternalist” measure that fully delinked transfers from work or other behavioral requirements.

As late as the 1950s, however, the NIT and similar grant proposals had not circulated far beyond narrow circles of economists and policymakers. The immediate postwar period was defined by the interlocking imperatives of high growth, full employment, and Keynesian stabilization. These “welfare worlds” of midcentury were underpinned by mass parties pushing for programs that met specific needs—like social housing—both within work and outside it. The presuppositions of the NIT, Jäger and Zamora suggest, were entirely out of step with such developments.

The terrain for this initially “untimely” idea began to shift in the early 1960s, given the dramatic “rediscovery” of poverty in the United States as epitomized by tracts like Michael Harrington’s The Other America (1962). Friedman’s NIT proposal, republished in his bestseller Capitalism and Freedom of the same year, suddenly received a decidedly more positive reception. In a decade characterized by the shockingly stubborn persistence of poverty—whose numbers were newly visible in increasingly sophisticated income statistics and increasing welfare rolls—and by the new specter of “automation” that appeared to threaten full employment itself, the formerly marginal idea of basic income began to appeal to a surprisingly heterogeneous set of constituencies.

Subscribe to our newsletter to get our latest essays, archival selections, and exclusive editorial content in your inbox.

For “commercial Keynesian” economists in Washington like James Tobin and Walter Heller (architect of the 1964 tax cut), fiscal policy was above all a technical question of fine-tuning aggregate demand. As they saw it, basic income had the advantage of elegance and simplicity, quite unlike the inefficient social programs whose social dimensions of solidarism or mutuality they largely disregarded. Meanwhile, a manifesto on “The Triple Revolution” in 1964—signed by signatories as diverse as chemist Linus Pauling, futurologist Robert Theobald, economist-sociologist Gunnar Myrdal, and Students for a Democracy Society leaders Todd Gitlin and Tom Hayden—warned of the possible “disappearance of work” in the age of cybernetics and directly endorsed an “unqualified right to an income” inspired by the NIT. Momentum continued to gather pace, particularly within academic and policy circles. By 1968 more than a thousand economists had signed on to the idea in an open letter, with prominent supporter and economist Paul Samuelson boasting in Newsweek that “any plan that simultaneously commands the allegiance of professor Milton Friedman and John Kenneth Galbraith must have a lot going for it.”

Such ideas were hardly confined to the seminar room or the halls of government. The vision of an imminent future beyond work found its most radical articulation in the work of Detroit autoworker James Boggs, who had already witnessed the early waves of automation-driven job loss in his own plant through the 1950s, the canary in the coalmine for the dramatic onset of deindustrialization that would engulf the urban Black workforce first and hardest. “How can the labor movement speak for Negroes,” Boggs declared in 1962, “when . . . 76 percent of Negro youth in Detroit are unemployed?” As he argued in the still powerful The American Revolution (1963), the inexorable forces of automation required a radical remaking of socialism, built on the principle that “everyone has a right to full life, liberty, and the pursuit of happiness, whether he is working or not.”

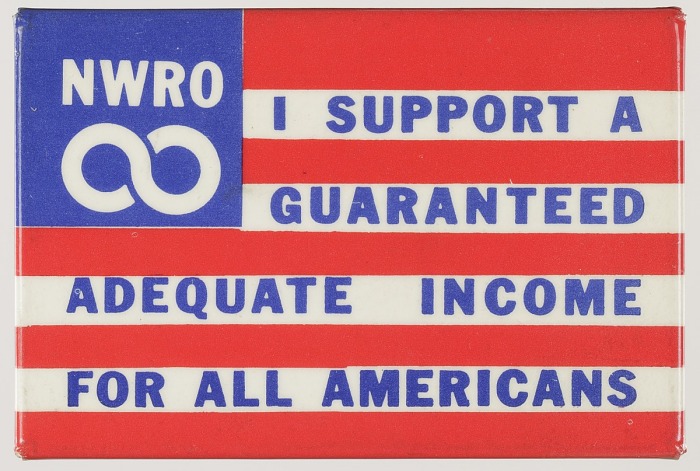

Boggs had signed the Triple Revolution manifesto in 1964, and similar fears about the disappearance of work would lead Martin Luther King to an endorsement of basic income by 1967 in the wake of his Poor People’s Campaign—a notable contrast to the job guarantee and expansive Keynesian vision of the “Freedom Budget” drafted by labor-aligned leaders of the civil rights movement only a year earlier. Meanwhile, 1966 saw the establishment of the National Welfare Rights Organization (NWRO), an organization of welfare recipients—nearly all women with children—who argued for fully removing work requirements and discriminatory “man-in-the house” rules from the welfare system. When sociologists Richard Cloward and Frances Fox Piven infamously proposed overwhelming the welfare system through mass enrollment, they declared that their “ultimate objective” was “to wipe out poverty by establishing a guaranteed annual income.”

By 1969 the idea of a guaranteed income had gathered enough steam that Daniel Patrick Moynihan won over President Richard Nixon in a proposed bill, the Family Assistance Plan (FAP), which would ensure up $1,600 a year (roughly $12,500 today) for all families under a given threshold. For Moynihan, who had authored a notorious 1965 report identifying family dysfunction as the root cause of Black poverty, the FAP presented a single sweeping solution to the built-in “disincentives to family formation” and the extensive social service bureaucracy of the existing welfare system. Opposed by advocates on the left (like the NWRO) for being too meager and by those on right (like the U.S. Chamber of Commerce) for reducing incentives to work, FAP passed the House in 1970 but ultimately failed to clear the Senate. The compromise proposals that emerged shortly in its wake—Supplemental Security Income and the Earned Income Tax Credit—have transformed the U.S. fiscal landscape and generated a dramatic increase in cash transfers in the decades since, with means-tested payments to the disabled and tax subsidies for low-income families conditional on work. By the early 1970s, however, the wave of interest in basic income dissipated as rapidly as it had crested. A proposed annual “demogrant” of $1,000 per person was not enough to save the 1972 George McGovern campaign from an ignominious defeat. A genuine basic income appeared dead in the United States.

Yet the story of basic income in Europe had only just begun. Throughout the late 1970s and early 1980s, Jäger and Zamora chronicle, a diverse cast of leftist thinkers increasingly sought to break with what they took to be the backward-looking “producerism” and cumbersome administrative state that they took to define mainstream social democratic parties and trade unions in western Europe. Many French advocates of autogestion (workers’ self-management) became convinced that automation and computing held out the promise of an imminent “cybernated” economy characterized by abundant free time. Meanwhile the libertarian currents of the post-1968 left nursed growing skepticism of what sociologist Pierre Bourdieu called the “exercise in stigmatization” and the “politics of disciplinarization and normalization” that characterized the existing social security system.

Work itself increasingly came under scrutiny, as in the Austrian-French theorist André Gorz’s best-selling Farewell to the Working Class (1980), which famously proclaimed that “productive activity” had “been emptied of its meaning, its motivations, and its object,” and that the present goal ought to be “to free oneself from work.” To this emergent “postwork” left, an unconditional cash transfer free of work requirements, with which each individual could do precisely as they wished, offered a possible horizon of individual autonomy and creativity beyond labor itself. Inspired in part by Gorz, the new Political Party of Radicals in the Netherlands proclaimed its support for a basisinkomen in 1982, and a year later the self-proclaimed “Dutch Council against the Work Ethic” held an “anti-May Day” protest in defiance of corporatist trade unions and the work ethic.

Welfare for Markets does not explain the uneven geographical uptake of basic income in Europe, but the neighboring Dutch ferment did provide an inspiration to the notable Belgian philosopher Philippe Van Parijs, who first sketched out his blueprint for his “impôt négatif” in 1982.

Trained at Oxford in the “analytical Marxist” tradition, Van Parijs proposed a version of basic income that sought to develop a “capitalist road to communism” marrying socialist values of egalitarianism and the progressive abolition of labor to the policy tools and principles of neoclassical efficiency. His vision was decidedly iconoclastic: “Why not,” Van Parijs and his coauthors in the Collectif Charles Fourier wrote in 1984, “get rid of employment insurance, legal pensions, state benefits and aid, study allowances . . . and state subsidies for ailing industries” and replace them entirely with a single stipend? In this vision, everyone would receive a sum sufficient to cover living expenses “regardless of whether the person in question was employed or unemployed, rich or poor, whether the person lived alone, with family, in partnership, or in a wider commune.” But this wasn’t all: for the Collectif, the basic income ought to be paired with deregulation of the labor market, the abolition of limits to the working day, of the minimum wage, the minimum age of schooling, and the maximum retirement age. “Do all of this,” the authors wrote, “and simply observe what will happen.”

The great advantage of proposals like UBI, Van Parijs maintained elsewhere, was precisely that “the beautiful simplicity of the left-right axis is pulverized before our eyes.” Van Parijs’s advocacy and organizational work would be critical in knitting together the diverse tendencies and thinkers which culminated in the Basic Income European Network (BIEN), which held its founding conference in Belgium in 1986. (Rechristened as the Basic Income Earth Network in 2004, BIEN remains the main advocacy organization for UBI worldwide.)

Yet the centrality of Van Parijs to basic income’s subsequent trajectory is telling. While Jäger and Zamora do not press this point, the late 1980s are precisely the moment when basic income largely retreated back into technocratic and academic milieux. As in the United States, basic income never fully crossed the threshold from a speculative proposal to a mass demand in Europe—let alone actual implementation. The same pattern has instead been reproduced: cash transfers have become the social program of choice on both sides of the Atlantic, with cash subsidies or vouchers replacing all manner of previously direct provision, as in the transition in the United States from public housing to Section 8. Aside from a continual froth of UBI “experiments,” a genuinely unconditional and universal income floor has never been introduced in sustained fashion anywhere. Ameliorating the direst outcomes of market society is one thing—but remaking the basic incentive structures of work itself is quite another.

Though the politics of basic income have consistently failed to cross the finish line in Europe and North America, Welfare for Markets documents a fascinating third act in the Global South. In the immediate postwar period, the central developmentalist imaginary had called for large, planned investments, rapid industrialization, and import substitution as means of catch-up growth and modernization. Even as this model faltered in 1970s, Third World countries organized to advocate a major restructuring of the world economy and the terms of international trade through proposals like the New International Economic Order. Yet as these ambitious efforts flagged in the face of the debt crisis of the 1980s and the intransigence of rich countries, the paradigm of international development began to shift instead toward a model of poverty alleviation. As historian Samuel Moyn has charted, such approaches narrowed their remit to meeting the “basic needs” of the global poor while abandoning earlier visions of remaking the global economy and ending the ever-growing “great divergence” of wealth between north and south.

Within this increasingly constrained and technocratic vision, “conditional cash transfers” (CCTs)—small and direct cash payments typically “conditional on recipients’ specific behavior patterns, such as children’s school attendance, visit to health clinics, or labor market participation”—became popular among both domestic elites and international development circles. As a direct means of poverty alleviation, such policies could palliate—but crucially, not interfere with—market-oriented “structural adjustments” and liberalization measures which targeted nationalized industries, public sector employment, in-kind benefits, and state subsidies across the Global South, often with devastating social effects. Pioneered by the African National Congress in South Africa post-apartheid in the mid-1990s (through both expanded and deracialized old age and child benefits), the model soon spread across the world, with 123 transfer programs in southern Africa by 2012 alone, and with flagship programs like Progresa in Mexico and the Bolsa Família in Brazil attracting significant international attention.

Notably, such CCTs are neither universal or unconditional. They are not, in other words, anywhere close to a true UBI. This embrace of conditionality poses a significant problem for the overall argument of Welfare for Markets, which insists on the anti-normative genealogy of the NIT and its successors. Jäger and Zamora dutifully attempt to link this CCT revolution to the advocacy of economists like Guy Standing, who have influentially argued for expanded and truly unconditional basic income as the only realistic program for economies apparently fated to permanently stagnant growth, high unemployment, persistent precarity, and sprawling informal sectors. Yet the analytical slippage is telling: as in Europe and the United States, the policy consensus in the Global South has congealed around a set of far more targeted and limited transfers than the income floor imagined by utopians on both the left and right.

As the conditions of informality and stagnation that once defined the Global South have increasingly seem to apply to the North, however, the idea of basic income has fittingly returned to prominence in the metropole. In the present “technopopulist” conjuncture that emerged in the wake of the 2008 crash, Jäger and Zamora contend, UBI proposals caught fire once more, embraced by the lords of Silicon Valley who again predict an imminent automation catastrophe for employment, by a new generation of “postwork” theorists on the left, and by the heterogenous populist formations springing from of the ashes of the midcentury mass party, from the Five Star Movement in Italy to Andrew Yang, which are drawn to UBI’s media friendly nature and its resistance to conventional left/right binaries. (As it happens, basic income ideas have also seen renewed interest in more conventional policy circles too: since 2022 the City of Chicago has run the largest UBI experiment of its kind in the United States, offering an unconditional $500 a month to lottery-selected sample of 5,000 residents.)

Drawing on French philosopher Marcel Gauchet, Welfare for Markets concludes that this continued ascendancy of basic income represents a triumph of the anthropology of the “sovereign consumer,” which for Jäger and Zamora “hints at a more profound break at the heart of modern political culture.” Rather than a focus on “monocausal neoliberalism,” they argue, the “global rise of cash transfers” hints at “a deeper and messier market turn that ran through many traditions and currents in the late twentieth century.” In what Gauchet calls the “second capitalist revolution” of the latter half of the twentieth century, it is the consumer, rather than the worker or citizen, who stands as the central subject for a world in which money has “found its proper place . . . an orbit which rises and sets like some artificial sun.”

It is precisely in this conclusion, however, that the analytical shortcomings of Welfare for Markets come into view. Can this metaphysic of money do the explanatory work that Jäger and Zamora ask it to do, given that social life has been principally mediated by money and markets in the Global North for several centuries now? After all, as the authors remind us with the book’s first epigraph, Karl Marx already offered a trenchant critique of the “cash nexus” by the 1840s—nearly a century before the height of the solidaristic politics whose downfall the book justifiably laments. If the monetary mediation of life is really so singularly corrosive, one might wonder how the New Deal emerged at all in a country where life insurance has been a mass industry since the Civil War. It is necessary to push deeper since, as Alyssa Battistoni observed in her political reading of Virginia Woolf’s A Room of One’s Own (1929), money is first and foremost a means to life itself. When Woolf marveled at the transubstantiation of the physical money in her hands after a small bequest left her a fixed allowance for life, her elation was entirely unrelated to the possibilities of individualized consumption. “It is remarkable,” Woolf observed, “what a change of temper a fixed income will bring about. No force in the world can take from me my five hundred pounds. Food, house and clothing are mine forever.”

One might expect to encounter this perspective in the words of transfer recipients themselves. Yet in perhaps the biggest shortcoming of the intellectual historical orientation of Welfare for Markets, such voices are entirely absent. Firmly ensconced in the world of planners, economists, utopians, technocrats, philosophers, and the occasional activist, the book notably overlooks the views of the poor, who are portrayed in precisely the same abstract fashion that Jäger and Zamora explicitly decry when it comes to economic theory. In the exception that proves the rule, the congressional testimony of NWRO Vice President Beulah Sanders is invoked only to liken her pleas for support to the notorious thesis of the Moynihan report. (In reality the NWRO’s members produced a fascinating repertoire of arguments about the role of welfare support in the micropolitics of domestic life.) This absence is all the more surprising given the well-known historical tendency of social programs—and cash transfers, in particular—to generate entrenched constituencies, with significant political consequences. This fact, already acknowledged by Dwight Eisenhower in 1954—“should any political party attempt to abolish social security, unemployment insurance . . . you would not hear of that party again in our political history”—was also clearly recognized by the unlikely figures of Donald Trump and Jair Bolsonaro, both of whom sought to ramp up transfers ahead of their reelection campaigns.

It may be that Jäger and Zamora are tempted by a metaphysical conclusion—that the rise of basic income proposals is at once the inevitable expression and unwitting handmaiden of the advance of market logic—precisely because their focus on ideas tends to obscure the political, institutional, and social conditions in which they have always been embedded. It is only by zooming out from ideas about basic income alone that the broader picture comes into view.

In contrast to the loose theorization of “technopopulism” in Welfare for Markets, for example, the cultural theorist Michael Denning has recently proposed that we think of populism as the expression of the livelihood struggles that cluster around what Marx once called the “secondary” forms of exploitation in democratic polities. By this Marx meant the distinctively modern forms—taxes, rent, debt, mortgage, interest—through which the social surplus is divided and fought over outside of and beyond the wage. Using this lens, we see not only that cash payments and transfers of various kinds have been a principal arena of politics for centuries, but that their separation from wage struggles is not necessarily evidence of the hypnotism of the market. Struggles over taxes and transfers are often (perhaps even always) class politics in another key. Jäger and Zamora appear to suggest that post-1960s visions of guaranteed income and struggles over welfare payments in the United States posed little challenge to the existing political-economic order, but this wasn’t how many entrenched interests saw it. The Californian anti-tax revolts of the 1970s, powered by suburban homeowners angry over fiscal transfers, developed the mass base of the New Right and ultimately propelled Ronald Reagan into office. From this vantage, we might begin to see basic income—and transfer payments more generally—not so much as the product of a singular “market turn” but instead as one front in a far broader terrain set out by the expansion of the fiscal state, the longstanding financial intermediation of daily life, and the changing patterns of work and family.

Indeed, the book’s narrow focus on intellectuals equally obscures the broader purchase of the idea at any given time. We are told that basic income ideas gained steam during the 1960s war on poverty, yet also that Johnson was implacably opposed. (He insisted on “no doles,” and as Nicholas Lemann notes in The Promised Land (1991), he asked that “anything that could be construed as a reference to putting cash in the hands of the poor people” be removed from his Council of Economic Advisers’ 1964 report.) Jäger and Zamora revel in the carnivalesque ideas and social pressure campaigns of the postwork left, yet they also concede that Dutch Labor Party repeatedly affirmed its commitment to full employment even during the 1980s high water mark of agitation—a pattern broadly repeated across the European social democratic parties, with basic income falling entirely off the mainstream agenda through the 1990s. More recently, a straightforward referendum on a basic income proposal in Switzerland in 2016—whose GDP per capita exceeds that of the United States—saw a fairly staggering defeat, with 77 percent voting against. And despite the apparent rise of “technopopulism” in the 2010s, Yang’s viral endorsement of the policy for his 2020 presidential campaign netted him a humiliating 2.8 percent of votes cast in the New Hampshire democratic primary. So much for the ultimate triumph of the sovereign consumer.

The apparent paradox of intellectual success and political marginality can be resolved only by taking a broader view. It has always been far cheaper for the state to police, control, and imprison the castoffs from market society than to engage in the genuine redistribution that even the most minimal floor of basic income would require. This goes a long way to explaining the highly limited and conditional nature of nearly all actually existing cash transfers worldwide. As Zamora has noted, even a fairly modest proposal of €1,100 ($1,300) a month (in addition to existing benefits) in France was costed at 35 percent of GDP. A genuinely emancipatory UBI at a level high enough to avoid subsidizing existing forms of precarious and low-wage employment, moreover, has always had a still more serious count against it: undercutting the compulsion to work would severely undermine the power of the employer class. That is why basic income is and will always remain fundamentally inimical to capitalists—despite what some Big Tech executives may say—for the same reasons that economist Michał Kalecki famously identified in the case of full employment. (This homology also explains why the perennial dichotomy set up in the contemporary U.S. left between UBI on the one hand and a “job guarantee” on the other is false.) Although Welfare for Markets does not attempt such an account, one might even see the booms and busts of basic income thinking in the Global North as related to what Kalecki called the “political business cycle,” with upswings of interest in periods of serious economic dislocation (in the late 1960s/early 1970s and after 2008) and decline in periods of tighter labor markets or greater stability (the 1950s, 1990s, and perhaps now the 2020s).

Jäger and Zamora are certainly right to decry the fundamentally deleterious neoclassical outlook that refuses to consider any “inefficient” collective or in-kind provision of needs and benefits. At a minimum, any halfway adequate response to the threat of climate catastrophe will require a total break with the hypostatized worship of the sovereign consumer-individual—the market deference that is built into even microeconomic tools that guide all policymaking. It will require, too, a critical theory of needs that understands their inescapably social and collective determination. To take just one example, the recent American obsession with lumbering “utility vehicles” is as much an expression of loopholes in emissions regulation as it is of authentic individual desire. Rapid decarbonization simply cannot rely on the aggregate outcome of individual consumer decisions, no matter how many “nudges” or “incentives.” (The latter would seem to negate the putative “sovereignty” of the individual, in any case.) It will instead require dramatic public intervention to reshape the basic infrastructure of life itself, and ultimately, perhaps, even democratic control over the investment function.

Progressive advocates of basic income must bear the burden of explaining why it will not naturalize a deference to individuals and markets that prevents a meaningful collective answer to these emergencies, but it is essential to recognize that what stands in the way of their robust vision is precisely what stands in the way of the less marketized future Jäger and Zamora appear to want. Loosening the yoke of market compulsion through any instrument—in cash or in kind, through transfer or through contract, via the workplace or the state—will require enough power to overcome the same entrenched interests. Pace John Maynard Keynes, who thought that “the power of vested interests” was “vastly exaggerated compared with the gradual encroachment of ideas,” the world is ruled by little else.

An edited version of this essay appears in our print issue, On Solidarity. Boston Review is nonprofit, paywall-free, and reader-funded. To support work like this, please donate here.