Adam Smith’s America: How a Scottish Philosopher Became an Icon of American Capitalism

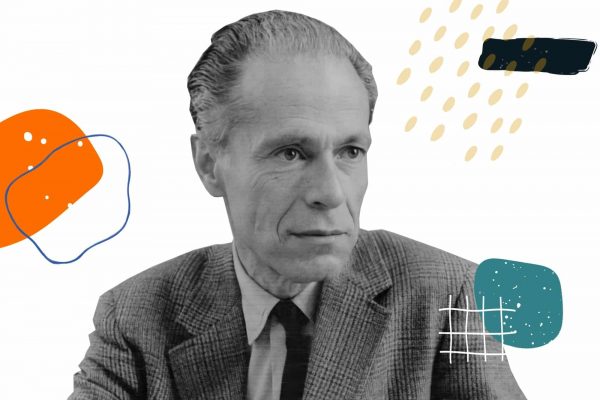

Glory M. Liu

Princeton University Press, $35 (cloth)

One puzzle in the intellectual history of the twentieth century is why the University of Chicago became the leading bastion of free market economics.

Scholars have proposed compelling explanations, from the strong rooting of “price theory” at Chicago by the end of the 1930s to the participation of many of its faculty members in postwar, pro-market advocacy groups that began to embrace neoliberalism by the 1960s. But having spent most of my adult life at the university and in its surrounding neighborhood of Hyde Park, I can’t help but wonder about a more quotidian contributing factor: the area’s limited range of commerce in the days when Milton Friedman, Friedrich Hayek, and George Stigler walked these streets.

Hyde Park is on Chicago’s South Side, not the posh North. The area once buzzed with urban commercial traffic—right after World War II, when many Black people moved to the city from the South in order to work in factories. Famous jazz and blues clubs abounded on the neighborhood’s central commercial corridor of 55th street, where legends like Coleman Hawkins, Art Blakey, Thelonious Monk, and Sonny Rollins played. But then the factories began to shutdown. Poverty and street crime rose. The U.S. “urban crisis” fell on Chicago.

At the university, fears arose about white flight and a potential diminished ability to recruit students and faculty. Thus began a decades-long “urban renewal” project in Hyde Park, carried out by the city and the university. Launched in 1952, the effort became one of the largest of its kind in the United States. Jane Jacobs, in The Death and Life of Great American Cities (1961), called the initiative “opprobrious.” The project demolished 55th street, selling lots back to private developers who built low-slung condominiums and two hulking modernist I. M. Pei apartment towers. Automobile traffic was routed away from the neighborhood, and access to public transportation, including the city’s “L” train, was cut off to keep poor (often Black) people out. Wielding eminent domain and controlling so much local property, the university undermined much commercial activity, anxious to keep outsiders from traveling into the neighborhood. Hyde Park saw its population and urban density dramatically decline, becoming a relative commercial desert within the larger metropolis.

By the end of the twentieth century, the university began to change course, recruiting more businesses to open establishments. I recall, as a doctoral student in the mid-2000s, standing in line when the first Starbucks opened, on 55th street. I waited alongside one of my more intellectually intimidating professors, as we readied our orders. Before our turn came, the barista informed us that we could not be served; they had no more coffee beans. Locals shrugged knowingly at each other, as if to say, “only here does Starbucks run out of coffee.” It would take time for multinational corporate enterprise to conquer Hyde Park, but eventually it did.

In his instant classic Globalists (2018), historian Quinn Slobodian traced the origins of what he calls the “Geneva School” of neoliberalism to the experiences of a group of men in Vienna—Hayek, along with Ludwig von Mises, Alexander Rüstow, Wilhelm Röpke, and Michael Heilperin—who lived through the disruptions of world war followed by the breakup of the Habsburg empire. To replace Austro-Hungary, they dreamed up a new imperial project: a global market capitalism free from the fetters of the twentieth-century social democratic state.

I can imagine how a complementary history titled Localists might go—placing the Chicago school in the context of Chicago itself, tracing the experiences of these men as they moved through the streets of Hyde Park. Given its now ample coverage, Friedman’s and Stigler’s membership in the transnational network of neoliberals organized by Hayek at Mont Pelerin, Switzerland, in 1947 could be passed over. Space could be devoted instead to the dearth of business establishments and to all the university-claimed property on Friedman’s daily walk, between his family’s Hyde Park home and his office in the university’s Social Science Research Building. Could it be that this parochial context fanned the flames of market fundamentalism?

Another suggestive fact is that Hayek’s pro-market libertarian leanings only intensified after he accepted a position at the university’s Committee on Social Thought in 1950 and came to live for over a decade in Hyde Park, where he wrote The Constitution of Liberty (1960)—after having lived in Vienna and London. Stigler, for his part, took his PhD at Chicago in 1938 and spent more than a decade at Columbia, where he worked on the Manhattan Project, before returning in 1958—the same year the city of Chicago approved a “master plan” for the urban renewal project, and a year before the university acquired powers of eminent domain thanks to federal legislation. By 1961 Stigler would start one of his most influential articles by commenting that the theory of information “occupies a slum dwelling in the town of economics.” Local context, it seems, crept in.

No doubt, Stigler at least would reject this perspective on intellectual history. In 1976, when Hyde Park was approaching its urban commercial nadir, the University of Chicago Press published a bicentennial edition of Adam Smith’s An Inquiry into the Nature and Causes of the Wealth of Nations with a preface by Stigler, whose research focus was economic regulation. I carried this edition under my arm in graduate school (as Chicago undergraduates still do today), after I convinced one of my professors to grant me a course credit for reading a syllabus on “classical political economy,” for which I selected two texts, Smith’s Wealth of Nations and Marx’s Capital.

How striking was the difference between Stigler’s preface to The Wealth of Nations and Ernst Mandel’s introduction to Capital, also published, coincidentally, in 1976. Where Mandel offered a laborious, seventy-six-page exegesis of Marx’s “dialectical method of investigation,” Stigler gave a breezy gloss that barely crept onto a fourth page. He informed the reader that “the fundamental explanation of man’s behavior, in Smith’s view, is found in the rational, persistent pursuit of self-interest” and that Smith “never married” (presumably in his own self-interest), but not much more. What was this guy’s deal, I wondered?

It turned out that Stigler had already asserted that “the correct way to read Adam Smith is the correct way to read the forthcoming issues of a professional journal”—the positivist reading method he evidently applied to preface writing, too. Stigler also pronounced in his Essays in the History of Economics (1965) that “the dominant influence upon the working range of economic theorists is the set of internal values and pressures of the discipline” and that to investigate any historical context “related to the development of economic theory” is “an exercise in erudition, not in explanation.” He surely would have dismissed any effort to explain his ideas by reference to such vulgar context as his own local surroundings.

But even if my hunch is wrong—even if the Chicago school’s free market advocacy was in no way stoked by contempt for eminent domain, the power of city planners, and the resulting lack of enterprise in Hyde Park—a larger point holds: Stigler got more mileage from quoting The Wealth of Nations than he would have if he had just complained about personal inconveniences he suffered due to Chicago’s municipal zoning regulations. To shore up their intellectual authority, intellectuals cite the authority of bygone intellectuals. Much less often, mercifully, do they recount their own daily life’s irritations or pleasantries—even when these and not passages from their favorite books shape their highest intellectual commitments. (Just how much has my own writing about the economy—so informed by Keynes, the Chicago’s school archenemy—been shaped by my own daily walks, past the gorgeous building that today houses the economics department to my office in the now shabby Social Science Research Building, where the roof sometimes leaks?)

Rather than pondering the local contexts of their own thought, thinkers more typically project themselves into the thoughts of those who lived before them, often long before them. From these encounters, much misreading and misunderstanding follows—but so, through creative appropriation, does much insight. The history of ideas chugs along.

That there is much to learn from these encounters, something different from what debating what Adam Smith really meant, is the premise of “reception history.” Glory Liu’s careful study of the role played by Smith in American intellectual life over the centuries, Adam Smith’s America, is an exemplary version of this genre of intellectual history, joining such notable studies as Jennifer Ratner-Rosenhagen’s American Nietzsche (2011), Emily Jones’s Edmund Burke and the Invention of Modern Conservatism, 1930–1914 (2017), and Claire Rydell Arcenas’s America’s Philosopher: John Locke in American Intellectual Life (2022). (A much-anticipated study of Marx’s reception in the United States, by Andrew Hartman, is forthcoming.)

Liu presents Smith’s reception history as a unique window into what she calls the nation’s “politics of political economy.” She is right, but in some cases there is more to say about the contexts in which reception takes place than she lets on. As it happens, one of the greatest lessons of Smith’s work itself is that we too often ignore local context at our peril.

Smith published The Wealth of Nations the same year Americans signed the Declaration of Independence. Despite the uncanny coincidence of the date, there was not enough time for Smith’s book to have influenced the American Revolution. Thomas Jefferson, James Madison, and Alexander Hamilton read Smith, who loomed over post-Revolutionary political economic debates, but not all that large. In the next chapter of Smith’s budding influence, early U.S. colleges used The Wealth of Nations as a textbook in their first courses in political economy. Then, over the nineteenth century, Smith commonly cropped up in public debates about the merits of U.S. industrial trade protection. Free traders cited Smith as their ally.

Smith was not yet a major figure. Still, Liu uncovers a noteworthy pattern. Those who leveraged Smith’s argument on behalf of free trade held it out as a universal truth—hard-won by a science of “political economy,” whose firm foundations Smith had set. Their antagonists did not dismiss The Wealth of Nations. Instead, they asserted that Smith, great though he was, was a thinker of his own times who must be read in historical context. In this instance, his criticisms of eighteenth-century British “mercantilist” trade policy did not directly translate into a convincing criticism of the nineteenth-century U.S. industrial trade tariff.

In the second half of Liu’s book, the pendulum swings about. Progressive economists, like Richard Ely, preferred the historicist reading of Smith. Next, in the hands of the post–World War II Chicago school, the universalist reading of Smith won the day. Only now, during the 1970s, did Smith truly become a public “icon of American capitalism,” to quote Liu’s subtitle.

At the turn of the twentieth century, progressive economists, the men who first split the professional study of “economics” in the U.S. off from its parent “political economy,” appealed to Smith’s entire oeuvre. They hoped that the new economics might still maintain contact with political economy’s parent of moral philosophy. Many of them, like Ely, had first studied economics in German universities, dominated by its heavily empiricist “historical school.” The German reception of Smith focused on the seeming tension between The Wealth of Nations and Smith’s first great work, Theory of Moral Sentiments (1759). The former began on the topic of self-interest, the latter with a lengthy discussion of sympathy. “Das Adam Smith Problem” was, do the two accounts fit?

Ely and his peers answered yes. Aiding their effort was the 1896 publication of student notes from Smith’s 1762–1763 Lectures on Jurisprudence. There, Smith declared that the maintenance of justice, not, say, market efficiency or economic growth, was “the first and chief design of every system of government.” Ely’s Smith, Liu writes, “stood firmly on the side of labor and tiptoed toward the edge of socialism.” For this generation, “If there was anything like a scholarly consensus around Smith . . . it was held together by shared interest in using Smith to illuminate the ethical and economic possibilities that existed between complete laissez-faire on the one hand and socialism on the other.”

That is where the (largely academic) reception of Smith stood, before the Great Depression struck and after it came FDR’s New Deal. Then Chicago’s Adam Smith enters the picture, and the story takes a sharp right turn.

For Liu the Chicago school’s appropriation of Smith is the pivotal episode in his American reception, meriting two chapters. Liu begins by noting a 1926 sesquicentennial commemoration held in Hyde Park. Chicago’s Smith was not distinctive yet. Philosopher Glenn Morrow called the Scotsman no apologist for “naked individualism,” while economist Jacob Viner held that The Wealth of Nations countenanced a “wide and elastic range of government activity.” In the classroom, Viner and his colleague Frank Knight were teaching their soon-to-be legendary Chicago course on price theory. Student lecture notes reveal that they deployed The Wealth of Nations mostly as a foil to demonstrate errors in economic analysis.

In 1946 Viner left Chicago for Princeton, Knight was easing into retirement, and Friedman, their former student, returned to Chicago as an associate professor. By 1958 Stigler was back, too, and the proverbial “second” Chicago school was born.

In the postwar decades, only Stigler fixated on Smith in his scholarship. One of the oddities of this history is that Smith was not the fountainhead of Chicago economics. Viner and Knight’s price theory was faithful to the “partial equilibrium” economics of the late nineteenth-century Cambridge giant Alfred Marshall (Keynes’s mentor, and the target of his intellectual parricide). Behind Friedman’s monetarism stood the Yale economist Irving Fisher’s quantity theory of money—and behind him, not Smith, but Smith’s great mentor, friend, and fellow Scotsman David Hume.

In Stigler’s positivist reading, there were things Smith got right and things he got wrong. The wrong could simply be dispensed with, the right—the universal truths—embraced. And what Smith got right, Stigler thought, was the primacy of “self-interest.” In Stigler’s reading, The Wealth of Nations was a “stupendous palace erected upon the granite of self-interest.” Stigler cited Smith in his theory of economic regulation. To Stigler, there was no such thing as the “public interest”—a cherished value for Ely’s generation of progressives. Thus, state regulations only expressed the self-interests of the economic actors they benefited, and probably the self-interests of state officials themselves, too.

Stigler became a Nobelist but not a public intellectual. Friedman became both, but he did not really turn to Smith until the 1970s, when he retired from his illustrious career as an academic to spend his time intervening in public debates. At this moment in the story, Liu pushes on, reading Friedman on Smith with the scrupulous care of an intellectual historian—the method that brought the narrative this far.

Additional perspectives could have helped these later chapters of Liu’s book. I have already speculated how the eradication of Black commercial life in Hyde Park might fit into the picture. One aspect of Stigler and Friedman’s relationship to Smith, in the register of affect not ideas, also deserves comment.

Ely thought Smith an ally of progressivism, but he did not wear an “Adam Smith’s best friend” T-shirt or a necktie featuring a cascading series of Smith silhouettes. Stigler and Friedman did. The white, male, conservative lionization of Smith should probably be placed within the broader “roots revival” of the 1970s, which saw the rediscovery of white ethnicity. Intellectual history is no more helpful to explaining Smith’s reception here than it would be to making sense of the rise of, say, 1970s Southern rock.

Added to this cultural setting must be a related political context. For if Stigler forthrightly offered a self-serving reading of Smith, cherry-picking the sentences he liked, Friedman did not try even that hard. He brazenly weaponized Smith in the Chicago school’s no-holds-barred assault on the New Deal state. Unlike Dwight Eisenhower and Rockefeller Republicans, the Chicago school rejected the legitimacy of the New Deal tout court. The fact that Smith became a public icon of American capitalism during the 1970s and 1980s is a testament to the Chicago school’s success in the shifting the terms of U.S. political economic debate from the merits of concrete policies to abstract generalities about the market and the state.

What a strange move it was to look to an eighteenth-century Scotsman for a trenchant critique of postwar American liberalism. Should one have wanted to critique it, the Chicago school had local advantages: there were few better places to see that postwar liberalism had failed than Hyde Park. The Democratic Party’s preferred regimen of urban “slum clearance”—followed by tax credits to indirectly induce private investment in lieu of adequate public investments—was not enough (and still is not enough). Economic development simply did not follow urban renewal—infamously branded “Negro removal” by James Baldwin. Instead, capital flight and white flight joined to gut local commerce in cities like Chicago.

In 1966 Martin Luther King, Jr. arrived in the city to lead the Chicago Freedom Movement, a prelude to the later Poor People’s Campaign. King led a march through an all-white neighborhood in Marquette Park on the city’s southwest side; a rock thrown from the white crowd hit his head. He had first given a speech at the University of Chicago in 1956 and returned two more times in 1959 and 1966. I do not know whether Friedman and Stigler attended his addresses. We do know that the Chicago school was no friend to civil rights legislation or to state efforts to redress urban poverty and advance economic opportunity.

They held principled reasons not to be. The most important ideological move the Chicago school made, in terms of politics, was the rhetorical lumping of all states all together and for all times. Tellingly, this move was evident in several statements Stigler and Friedman made about Smith. In 1976, at a bicentenary celebration of The Wealth of Nations in Glasgow, Stigler bizarrely declared, “I bring you greetings from Adam Smith, who is alive and well and living in Chicago.” Stigler did not say Smith’s legacy was alive and well in Chicago: he said Smith was. Similarly, around this time, Liu uncovers, Friedman gave a speech to the University of Chicago’s corporate board of trustees in which he proclaimed that, “but for the accident of having been born in the wrong century,” Smith would “undoubtedly have been a Distinguished Service Professor at the University of Chicago.”

The market is the market, and state is the state; thus divine right monarchies, military despotisms, and democratic republics are in essence all the same. This vision of politics, in which New Deal–era public utility regulations, eighteenth-century British imperial trade restrictions, the U.S. 1965 Voting Rights Act, and the thirteenth-century Mongol sacking of Baghdad are said to be more alike than dissimilar, just might be missing something important about what does or does not make sovereign states legitimate.

Too bad, because postwar American liberalism deserved critique. Stigler was not wrong to suggest that state regulatory authorities can be captured by private economic interests, and Friedman’s speeches against the military draft of the Vietnam War hold up quite well today. But it is remarkable that Friedman, who lived in this midst of the commercial destruction of Hyde Park, never once commented on it in his abundant public writings.

The problem was that these men were too quick to jump to the highest level of abstraction, to insist that the only possible solution was to let the market and not the state decide. That is a vacuous mantra, but it has real consequences—for example, leading a free market economist to jump into bed with Pinochet simply because the general says nice things about the market. Would it not have been better to have consulted for the local Hyde Park Chamber of Commerce?

For historians of ideas, it is commonplace, when recounting the Chicago school’s reading of Smith, to lament just how bad of a reading it was. Liu cannot resist this temptation, but by placing it in the longer history of Smith’s American reception, she shows that there is more to learn from the episode than just confirming that Stigler was not a very sophisticated historian of ideas.

Indeed, Liu demonstrates just how malleable ideologically the interpretation of Smith has been over time. This is not true for all thinkers. Readings of Marx have varied over time, but they have not jumped over the ideological firewalls that typically separate right from left in just the same way. What does this say not about Smith’s reception, but Smith’s thought itself?

Chicago’s version of Smith led to a wave of late twentieth and early twenty-first century scholarship on his thought. Liu discusses this work in her last chapter, when the setting abruptly shifts from the Reagan White House and the pages of the Wall Street Journal back to university seminar rooms and academic journals.

The Chicago school sought out a single, overarching insight of universal application in Smith’s writings, and they claimed they found it in his celebration of self-interest and the market. In my reading, what the last generation of Smith scholarship has demonstrated so well is that Smith arrived a different single, overarching insight, which has nothing to do with political economy per se: we should be wary of single, overarching insights, which purport to transcend time and place. The move to generalize and abstract is often necessary in order to say something useful about a subject, but the desire to do so can be dangerous and should often be tempered.

Smith held that we are all deeply situated in our surroundings and circumstances. His greatest teaching was that, if we only stop to look, we are all localists. A splitter not a lumper, Smith preferred particularist to universalist accounts, across a wide variety of topics. In Theory of Moral Sentiments, Smith underscored the phenomenological experience of sympathy, rather than hunting for categorical imperatives. His discussion of justice in his Lectures on Jurisprudence (1762–3) offered no comprehensive theory; Smith did not finish the manuscript and willed it burned after his death.

In similar fashion, The Wealth of Nations is full of piercing insights, most famously about the relationship between the “division of labor” and the “extent of markets.” But it offers neither a comprehensive theory of the market nor a categorical imperative that self-interest should or must always rule in economic life or in analysis of it. When he wrote about the merits of economic self-interest, Smith was not advocating laissez faire. Rather, his version of the Enlightenment faith in reason told him that merchants and peasants alike understand local economic conditions better than government officials. Smith also held that governing should not be left to businesspeople, given their partial interests, and should rather be left to the hands of government officials whose job it was to look out for the public interest.

Smith’s particularism means his writings are not always consistent with one another, but there is only Das Adam Smith Problem if one demands that a single thinker’s thoughts must comprise a single systematic whole free of contradictions. Some thinkers metaphysically yearn to create a perfect complete intellectual system; their successes may be judged according to the standards they set for themselves. Smith was not among them. He had no such ambition.

There is worth in comprehensive systems. At times, politics demands ideological stridency. Smith offers something valuable of a different kind. Being a localist, Smith was not much of an ideologue at all—a fact which makes Liu’s reception history, in which ideologues like Friedman, Thatcher, and Reagan celebrated him, so fascinating and ironic. The greatest mistake that Stigler and Friedman made was not so much to position Smith on the rightward end of the ideological spectrum but to read him as a discoverer of scientific, universal truths that easily translate into ideological slogans.

Yet another mistake made by Stigler and Friedman was that they did not learn well from their teachers. Viner, their professor at the University of Chicago, wrote a classic essay, “Adam Smith and Laissez Faire” (1927), arguably the best treatment of the topic then or since. Rightly, Liu quotes the relevant passages from it at length. Let Viner have the last word:

Adam Smith was not a doctrinaire advocate of laissez faire. He saw a wide and elastic range of activity for government, and he was prepared to extend it even farther if government, by improving its standards of competence, honesty, and public spirit, showed itself enticed to wider responsibilities. . . . He devoted more effort to the presentation of his case for individual freedom than to exploring the possibilities of service through government. . . . [but] Smith saw that self-interest and competition were sometimes treacherous to the public interest they were supposed to serve, and he was prepared. . . . to rely upon government for the performance of many tasks which individuals as such would not do, or could not do, or could do only badly. He did not believe that laissez faire was always good, or always bad. It depended on circumstances; and as best he could, Adam Smith took into account all of the circumstances he could find.

We’re interested in what you think. Submit a letter to the editors at letters@bostonreview.net. Boston Review is nonprofit, paywall-free, and reader-funded. To support work like this, please donate here.