The Price of Peace: Money, Democracy, and the Life of John Maynard Keynes

Zachary D. Carter

Random House, $35 (cloth)

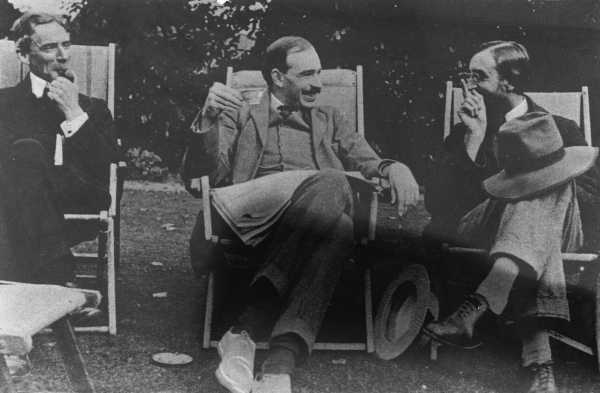

On September 9, 1938, John Maynard Keynes, fifty-five years old and the most famous economist in the world, read his essay “My Early Beliefs” to the Memoir Club, a circle of Bloomsbury Group friends who gathered occasionally to discuss the private reflections of its members. Keynes took the opportunity to revisit the philosophical principles of his confidants in the youthful exuberance of their twenties, “our mental history in the dozen years before” World War I. The rich, dazzling memoir, published posthumously at Keynes’s request (and subsequently included in his Essays in Biography), is well described by biographer Robert Skidelsky as “a key document for understanding his life’s work.”

The Keynes of “My Early Beliefs” was no longer a young man; recovering from a major heart attack, he read to the group reclining on a sofa to conserve his energy. Moreover, 1938 was not 1910; the intervening decades, shattering a long period of peace and prosperity, were characterized by war, disorder, and depression. Armed with this melancholy hindsight, Keynes would chastise his youthful cohort: “as the years wore on towards 1914, the thinness and superficiality, as well as the falsity of our view of man’s heart became, it now seems to me, more obvious.” And as the Memoir Club assembled that evening, German troops were massed on the Czechoslovakian border, and Neville Chamberlain would soon climb aboard an airplane for the first time in his life, that he might reason with Adolph Hitler. This context surely informed Keynes’s retrospective lament, “we were not aware that civilisation was a thin and precarious crust” layered atop a cauldron of horrors simmering just below the surface.

Nevertheless, Keynes never wavered from the core principles of his early beliefs: “this religion of ours . . . remains nearer to the truth than any other that I know,” he wrote. His memoir articulated the central tenets of that shared philosophy: the commitment to a relentless interrogation of established norms and traditions, a rejection of shallow materialism, and a reverence for “love, the creation and enjoyment of aesthetic experience and the pursuit of knowledge.”

For Keynes, economics mattered because it would ensure people need not organize their lives around the empty chase of money. It would free them, instead, “to live wisely, agreeably and well.”

The Price of Peace, Zachary D. Carter’s new biography of Keynes, is insightfully grounded in three touchstones of Keynes’s life that are neatly encapsulated by “My Early Beliefs”: the horrors of World War I, his intimate association with the Bloomsbury community of iconoclastic writers and artists (including Virginia and Leonard Woolf, E. M. Forster, and Lytton Strachey), and the essential inseparability of economics from broader philosophical questions. The Great War shattered the illusion that civilization was secure—and much of Keynes’s efforts in the three decades that followed were designed to save society from dystopias looming in the wings, particularly in the varied forms of authoritarian collectivism. Bloomsbury, to which The Price of Peace returns unfailingly throughout its narrative, properly situates both profound friendship, and, especially, a veneration of the arts, at the center of Keynes’s worldview. As for philosophy, Carter’s Keynes is “the last of the enlightenment intellectuals who pursued political theory, economics, and ethics as a unified design.” To approach Keynes’s economics innocent of such an understanding is to miss much, if not everything.

Across the first two-thirds of its pages, The Price of Peace is a breathtaking triumph. A renaissance man with a dizzying array of interests, pursuits, and accomplishments, Keynes sat prominently at so many diverse, rarified tables that just keeping up with him is an achievement, to say nothing of situating his life—really his lives—in broader context. Yet Carter does just that, in this smartly written, swiftly moving, well-researched, clear-eyed treatment of one of the most remarkable figures of the first half of the twentieth century.

Carter also has a good eye for spotting key contributions from Keynes’s vast writings, calling attention to essential essays including, among others, “The End of Laissez-Faire,” “A Short View of Russia,” “Economic Possibilities for our Grandchildren,” “Can Lloyd George Do It?” (all of which are reprinted in Keynes’s Essays in Persuasion), and, less well known but not to be underestimated, “Art and the State” and the innovative “How to Pay for the War.” In “Economic Possibilities,” Keynes touched the core of his understanding for why economists mattered: by solving the “economic problem” (the imperative to provide for adequate physical comfort and satisfactory necessities), people would no longer need to organize their lives around the empty chase of money, and instead have the freedom to pursue their varied, idiosyncratic interests that would allow them “to live wisely, agreeably and well.”

Short of that utopia, “The End of Laissez-Faire” (1926) heralded Keynes’s dramatic break with economic orthodoxy, signaled by his (then) heretical declaration, “The world is not so governed from above that private and social interest always coincide.” This disenchantment would grow still more pointed in the depths of the Great Depression: laissez-faire capitalism, he declared, “is not intelligent, it is not beautiful, it is not just, it is not virtuous—and it doesn’t deliver the goods.” Along with “Am I a Liberal?” and “Poverty in Plenty: Is the Economic System Self Adjusting?” the essay “Laissez-Faire” marks the steps on the road to the Keynesian revolution that would culminate with the publication of his magnum opus, The General Theory of Employment, Interest and Money, in 1936. But that runs ahead of the story.

• • •

Keynes was raised in an environment of reasonable comfort, and, more important, implicit security. His father, Neville, was a successful professor and administrator at the University of Cambridge; his mother, Florence, was a remarkable figure, active in social causes and local politics (she would eventually serve as the mayor of Cambridge). Keynes flourished at the storied Eton prep school, winning rafts of academic prizes, and then again at King’s College, Cambridge. After graduation he entered the Civil Service, laboring briefly in the India Office before being lured back to Cambridge, where he would teach economics, serve as editor of the prestigious Economic Journal, and publish his first book, Indian Currency and Finance (1913). Yet at age thirty Keynes was still more promising than accomplished. Everything would change in 1914.

The mass slaughter of World War I was the defining trauma for a generation of Europeans; it was also, for Keynes, where abstract economic theory collided with reality. Rushing to contain the financial panic unleashed by the commencement of hostilities (and taken aback by the short-sighted behavior of the financial community), Keynes learned from this experience, Carter argues, that markets “were social, not mathematical phenomena.” The precariousness of financial sentiment, and the key role that psychology plays in shaping those instincts, would remain essential to Keynes’s writing throughout his career, a disposition likely honed by his principal responsibility serving in the Treasury Department during the war—finding ways to creatively scape the bottom of the barrel of British finance (and, increasingly, to manage its desperate economic dependence on the United States).

The mass slaughter of World War I was the defining trauma for a generation of Europeans; it was also, for Keynes, where abstract economic theory collided with reality.

After the war Keynes was attached to the British delegation in Paris, ultimately resigning in protest over the Treaty of Versailles, which he cogently argued would prove a disaster. His polemic against the treaty, The Economic Consequences of the Peace (1919), would unexpectedly bring him world fame; no one anticipated that a technocrat’s dissent would sell over 100,000 copies and find translation into a dozen languages. The book—described by Carter as “a landmark of political theory and one of the most emotionally compelling works of economic literature ever written”—is also, to this day, misunderstood. Moreover, for all its purportedly enormous (and in some circles, nefarious) influence, it was patently unsuccessful in bringing about the policies that its author was passionately advocating. Mostly remembered now for arguing that the reparations imposed on Germany were too high, Economic Consequences was primarily concerned with what the treaty failed to do: attend to the shattered economic heart of Europe. Without addressing the urgent problems wrought by years of total war, the inevitable economic chaos that would follow would in turn lead to political upheaval. “Men will not always die quietly,” Keynes warned, and “in their distress may overturn the remnants of organization, and submerge civilization itself.”

Keynes proposed, at the conference and in print, a “grand scheme” that included modest reparations, the cancellation of inter-allied debt, and large new U.S. loans to Europe. The plan was, from a political perspective, naïve at best. Yet, as Carter notes, after a half decade of economic and political disarray, the U.S.-sponsored Dawes plan of 1924 was “essentially a delayed, expensive caricature of the system Keynes had urged at Paris.”

In the 1920s Keynes held no official government positions (those bridges had been torched), but he was now a prominent figure active on many fronts, producing two important scholarly books, numerous political pamphlets, reams of journalism, and advocating for the positions of the Liberal Party. A Tract on Monetary Reform (1923) is distinguished by Keynes’s attack on the “barbarous relic” of the gold standard, which he argued was inherently deflationary. (Casual critics of Keynes often hand-wavingly label him an inflationist, but in fact Keynes was quite anxious about inflation, which he thought would undermine faith in the legitimacy of the capitalist order. His position was simply, and quite rightly, that in those circumstances when forced to choose, in practice deflation was typically the greater evil.)

Keynes’s concerns along these lines were more explicitly articulated in yet another polemic, “The Economic Consequences of Mr. Churchill,” written after Keynes had failed to personally dissuade the then chancellor of the exchequer from returning the pound to the gold standard in 1925 at its long-standing pre-war value. The decision was a triumph of the interests of finance over industry, but one that would, as “Economic Consequences” predicted, prove disastrous for the British economy. These struggles informed the central concern of Keynes’s massive, sprawling, two-volume Treatise on Money (1930), namely, how to balance the goals of domestic monetary policy autonomy and international monetary stability. Carter makes the case that the contributions (and intellectual influence) of the Treatise are generally underappreciated today. And there may be something to that—legend holds that when Joseph Schumpeter read the book, he literally burned the manuscript on monetary theory he had been laboring on, concluding that it had been rendered obsolete. But with the deepening of the Great Depression, Keynes was already racing ahead, developing what would emerge as The General Theory.

The Price of Peace is somewhat less sure-handed in its treatment of The General Theory, which, despite bringing about a fundamental transformation of our understanding of economics, is a difficult book. Keynes follows several strands of complex argumentation without pausing to guide the reader through the thicket, and his prose is uncharacteristically workmanlike. Nevertheless, The General Theory was a sensation, initially dividing the profession along ideological and especially generational lines. Within fifteen years its influence had reshaped the profession.

Laissez-faire capitalism, Keynes declared during the Great Depression, “is not intelligent, it is not beautiful, it is not just, it is not virtuous—and it doesn’t deliver the goods.”

Once again, Carter is spot on in emphasizing the essential role of psychology, and especially the role of the collective sentiment of investors, for Keynes’s thinking. (Entrepreneurs were not driven by cold calculation but by “animal spirits,” Keynes wrote, and investors were not rewarded for calculating the underlying value of an asset, but for their ability to divine what other market players would find attractive. This in turn meant that the financial sector, left to its own devices, was unstable and prone to crisis.) And Carter is exactly right to emphasize that Keynes’s urgent, underlying motives remained largely conservative: he wanted to save capitalism from itself. Unfettered capitalism—unfair, unjust, ugly, vacuous of social purpose, and ultimately inefficient—would bring about its own ruin. Worse still, left unreformed, it would likely unleash things that were much, much worse. Keynes, from the very start, was under no illusions about the horrors of fascism (unlike many of the British right, who were content to avert their eyes), and he had no taste, fashionable in many left-leaning Western circles of the day, for the Soviet experiment—the inherent brutality of which he saw through ten years before the show trials of the 1930s.

But to unpack the economics of the Keynesian Revolution readers should pay close attention to chapter twelve of The General Theory (“The State of Long Term Expectation”) and Keynes’s 1937 paper in the Quarterly Journal of Economics, “The General Theory of Employment,” his response to leading academic critics of the book. Especially in the latter it is unambiguously clear that Keynes’s breakthrough was founded on two fundamental departures from orthodoxy. First, an economy, once stuck in a rut, could remain in a rut. And second, actors in the economy made decisions in an environment characterized not by risk (where the underlying probabilities of future events are properly understood and generally shared), but uncertainty (a setting where the future is inherently unknowable). “The orthodox theory assumes that we have a knowledge of the future of a kind quite different from that which we actually possess,” Keynes explained. “This hypothesis of a calculable future leads to a wrong interpretation of the principles of behavior . . . and to an underestimation of the concealed factors of utter doubt, precariousness, hope and fear.”

• • •

Across the long arc of its narrative, The Price of Peace devotes considerable attention to events in the United States (and Keynes’s attempts to influence and encourage President Roosevelt and aspects of the New Deal), strands which tie together most naturally during the 1940s. Keynes would devote the final years of his short life—he suffered from serious heart disease—to once again representing his government on matters related to the financing of a world war and its aftermath. This required regular travel to the United States from 1941 (when Keynes led negotiations over the terms of lend-lease aid) through 1946 (with the culmination of a series of exhausting multilateral conferences that led to the creation of the Keynes-inflected International Monetary Fund and World Bank). Over these years Keynes essentially worked himself to death in the service of his country. A major heart attack on a train bound for Washington in March 1946 preceded the one that would take his life, at home, one month later.

Entrepreneurs were not driven by cold calculation but by “animal spirits,” Keynes wrote. This in turn meant that the financial sector, left to its own devices, was unstable and prone to crisis.

Across the decades, from the teens through the forties, Carter’s facility in bringing Keynes to life is impressive. The only false note struck in this rich, nuanced, multifaceted portrait is the eagerness of The Price of Peace to recast Keynes as a protectionist, a claim asserted repeatedly throughout the volume. It is certainly true that in the early 1930s, first in a reaction to the pressures on Britain’s balance of payments intensified by the asphyxiating gold standard and then with the complete collapse of international economic cooperation in the depths of the Great Depression, Keynes wrote in favor of some protectionist measures. That Keynes would dare even to sample such forbidden fruit testified, once again, to his relentless pragmatism and bracing unwillingness to be bound by thoughtless devotion to received doctrine. But such flirtations were always qualified and faded over time. Even in his strongest moment of advocacy for such measures, in 1932, Keynes still paused to observe, among other gestures at debunking protectionist myths, “Nine times out of ten [the free trader] is speaking forth the words of wisdom and simple truth.” And in 1944, when the prospects for the international economy were quite different, Keynes had this to say in the House of Lords: “The expansion of our export industries which is so vital to us would be much easier if obstacles to trade can be diminished or done away with all together.”

Still, despite the misstep on protectionism (and it is an occupational hazard for biographers of Keynes to see a version of the man through the lens of the author’s personal proclivities), it is hard to imagine improving on Carter’s final measure of his subject, which is worth quoting at length:

No European mind since Newton had impressed himself so profoundly on both the political and intellectual development of the world . . . In his economic work he fused psychology, history, political theory, and observed financial experience like no other economist before or since. Few lives have ever been lived in the same vibrant, eclectic excess as Keynes lived his. He was a philosopher who rivaled Wittgenstein, a diplomat who became the financial hero of two world wars, a historian who uncovered peculiarities of great Enlightenment figures and ancient currencies, a journalist who enraged and inspired the public, the patron of a famed artistic movement. He was as vain, petty, shortsighted and impolitic as he was generous, kindhearted, and persuasive. Few who encountered him in his element came away from the experience unchanged.

It is a disappointment that the last third of the book, which weaves it way through seven decades, does not meet the remarkable standard established in its preceding pages. It is hard to argue with the implicit subtext of these chapters: that the practice of postwar public policy in the United States, at times under the banner of “Keynesianism,” was in fact, from the start, a long, tragic retreat from the wisdom of Keynes. (Essentially, mainstream postwar Keynesianism was a tamed and housebroken interpretation of selected parts of the General Theory. For Keynes the free market was often dysfunctional, and the economy an unpredictable and occasionally dangerous beast, necessitating guidance by adroit improvisation. As domesticated by postwar economists, Keynesianism instead assumed highly functional markets that were more like automotive engines that benefited from occasional fine-tuning, which could be accomplished by a deploying a few standard, reliable tools.) But the execution of this agenda is idiosyncratic, uneven, and at times even clumsy, as if the book itself never recovers from the loss of Keynes.

Most unfortunate is the extent to which the balance of The Price of Peace is anchored in a peculiar fixation on the Canadian-American economist and paragon of American liberalism John Kenneth Galbraith—which is not a slight against Galbraith, a figure of uncommon achievement. But the justification for settling on a thinker whose “peculiar brand” of Keynesianism was a “sharp departure” from the master as the protagonist in the final chapters of this biography is never established. Yet he takes on Zelig-like quality, popping up constantly, often in the oddest of places. To take a minor example, did Nixon really harbor a “special hatred” for Galbraith? This seems unlikely. Nixon was a legendary hater, and a cursory glance at a half-dozen good books on the brooding, paranoid President yields little more than a few perfunctory mentions of Galbraith, and none with the seething vituperation reserved for assorted enemies like, say, talk show host Dick Cavett. This is a consequential diversion, because it muddies a key strand of argument Carter is pursuing: that Keynes’s legacy fell into the wrong hands.

For Keynes, unfettered capitalism—unfair, unjust, ugly, vacuous of social purpose, and ultimately inefficient—would bring about its own ruin. Worse still, left unreformed, it would likely unleash things much worse.

Paul Samuelson would emerge as perhaps the most influential (and representative) of a new generation of postwar “Keynesian” economists; he developed mathematical models of economics that derived directly from Newtonian physics. Keynes would likely have been aghast. “The pseudo-analogy with the physical sciences leads directly counter to the habit of mind which is most important for an economist to acquire,” he wrote to Roy Harrod in 1938. The young Americans were building on John Hicks’s earlier attempt to simplify the Keynesian revolution, and reconcile it with elements of the old orthodoxy. As Carter observes, however, Keynes had in fact “presented a conceptual framework totally incompatible with Hicks’ project.” Keynes’s student Joan Robinson labeled such efforts “bastard Keynesianism.” But the bastards won.

Following this line more purposefully could have disciplined the closing arguments of The Price of Peace, as there is a straight line to be drawn from the blunders of American “Keynesianism” in the 1960s to the rise of more conservatively oriented economic theories in the 1980s and subsequently a broad consensus in macroeconomic theory that was permissive of the catastrophic anti-Keynesian liberation of finance that followed. Instead, Carter reveals a preference for picking partisan fights that often obscure important subtleties, as seen in the strawmanning of Paul Volcker, and the conflating of New Classical Macroeconomics with Milton Friedman’s monetarism (though political bedfellows, their economic theories were miles apart). And the notion that “Vietnam underscored just how little Keynes had achieved at Bretton Woods” is simply not coherent.

Finally, The Price of Peace stumbles with its treatment of the crucial Clinton years, burying the Keynesian lede by focusing extensively on trade—the North American Free Trade Agreement and the World Trade Organization—before finally turning to the great sin against Keynes: financial deregulation. It is unlikely that Keynes would have been much moved by U.S. trade deals of the 1990s; his life’s work was that of a monetary economist and a macroeconomist, and he did not generally dissent from what we now call microeconomic theory (the allocation of goods through the price mechanism).

The trade deals of the 1990s were not the final, tragic destination of anti-Keynesianism. Keynes would have likely seen opportunities in the WTO and shrugged at NAFTA. (Though he surely would have sharply criticized the abject failure of U.S. public policy to compensate those who would inevitably lose from such agreements.) But he would have been apoplectic at the great American financial deregulation project. For Keynes, in The Treatise, The General Theory, and at Bretton Woods, the mortal threat to his economic vision came from finance, not trade. In 1941, looking back at the ruins of the depression and towards an imagined future, he wrote, “Nothing is more certain than that the movement of capital . . . must be regulated.” Unregulated finance was inefficient, and prone to crisis; additionally, the notion that the financial sector would metastasize into something other than a simple facilitator of real economic activity was, for Keynes, a caricature of the ugly, rapacious capitalism that would lead to its own ruin, as it nearly did in the 1930s. And perhaps will again.

Robert Skidelsky’s magisterial three-volume biography thus remains essential, as are Keynes’s own writings (and here again Skidelsky is a welcome guide, with this invaluable collection). But set aside what amounts to a lengthy, eccentric coda, and The Price of Peace offers the finest single volume on Keynes that most readers will ever have the pleasure of encountering