E. P. Thompson’s The Making of the English Working Class relates the story of a Manchester silk weaver who, in 1835, complained of being subjugated to the urgent demands of the market. This skilled artisan observed how capitalists determined the pace at which they worked, while workers faced externally imposed timelines. “Labour,” the weaver lamented, “is always carried to market by those who have nothing else to keep or to sell, and who, therefore, must part with it immediately.” Rejecting any comparison of workers and capitalists, he stated, “if I, in an imitation of the capitalist” refused to sell what I have “because an inadequate price is offered me for it, can I bottle it? Can I lay it up in salt?” No, he bitterly answered, “labour cannot by any possibility be stored, but must be every instant sold or every instant lost.”

It did not take Marx’s later dictum that workers are free in a “double sense”—to work or to starve—to explain the distinction between income and wealth to the silk weaver. Wealth is an asset, providing a buffer against unexpected shocks in the short term and economic security in the long run. On the other hand, labor (the means to one’s income) expires as soon as it stops. There is no way to store labor—to “bottle it” or “lay it up in salt”—thus working people navigate a series of urgent demands on their time and well-being.

It is this unequal capacity to secure a future, design reliable plans, and make credible promises that defines our era, not merely the inequality of income and wealth. Working people are confined in an interminable present, unable to escape the short-term demands of rent, debt, and food; illiquidity looms large and overshadows daily life. In stark contrast, corporations and the rich are able to contend with the threat of illiquidity, relying on past savings and expected future income to ensure their survival. We have long recognized that the working class is spatially confined and cruelly underpaid; we must also emphasize that they simultaneously struggle under timelines they do not choose.

The COVID-19 pandemic has reminded us of this reality, as U.S. corporations securely projected their futures in ways workers could not. In the first half of 2020 major corporations raised more than $1 trillion in cash to ride out the COVID-19 shock. These “war chests” of liquidity stand in contrast to the short timelines and punitive costs inflicted on citizens facing similar crises. Government policies allowed some corporations to leverage their market power and acquire the liquidity necessary to weather the storm. In many cases this corporate funding came with no immediate demands for repayment, as corporate bonds are often “bullet” coupons with the principle paid only at the end (rather than accruing over the course of the debt). Working people—many of whom were fired by the same companies receiving government assistance—were granted no such option. The credit card debt or payday loans that they might use for rent or basic goods after losing work quickly surpassed what little savings they might have had. Meanwhile wealthy people—able to work from home but prohibited from taking vacations—saw substantial rises in their savings, as spending declined and income remained more or less stable.

Working people around the world remain imprisoned on short-term horizons, unable to plan and organize along reliable timeframes available to those better off. In imagining and building a more just economy, we must think beyond merely raising wages and improving job security. A just economy necessitates the redistribution of assets and credibility, so working people can craft timelines on which they are equipped to make productive investments. Working people must have the means to choose and create their own futures. Without this, it will be impossible to build healthy communities and humane economies.

In the contemporary U.S. economy, a host of public policies—from retirement planning to credit subsidies—unequally dictate Americans’ futures. For example, consider how the tax code has historically subsidized college savings: it promotes the future well-being of the relatively comfortable (the families who expect their children to go to college and can afford to put money away for it), while doing little for the families who cannot set money aside for college plans. For those who must borrow money to pay college tuition, the monthly schedule of student debt disciplines and controls near-term horizons. In a recent study of student debt among middle-class families, Caitlin Zaloom details how the necessity of families to borrow against expected earnings erodes “the right to the future”—the autonomy to direct one’s life in a way that is not restricted by the “inequities and errors of the past.” Indeed, student debt disproportionately circumscribes futures for minoritized people in the United States, as it often overlaps with other forms of deprivation.

Housing is another arena in which the future is unequally distributed. It is widely known that real estate capital and governmental policy have been complicit in producing racialized disparities—through redlining, exclusive covenants, gentrification, and infrastructure investment. Less recognized is how housing inequality forecloses the futures of some while stabilizing the futures of others. While both mortgage owners and renters must make monthly payments, only the former wind up with an asset that they control indefinitely at the end of thirty years. Homeowners are therefore freed from having to earn money for shelter each month. No such reprieve greets renters at the end of three decades; instead, renters are stuck in an endless month-to-month rhythm, denied stability and the tax deductions available for mortgages. Meanwhile, wage stagnation and skyrocketing rent have produced an enormous growth in housing insecurity across the United States, with millions of people, including the employed, struggling to keep up with the relentless pace of rent—especially in the midst of a pandemic.

In the wake of COVID-19 and its cascade of closures, more people feel as if they are running out of time; demands on people’s wallets come far sooner than they can afford. Studies by the Federal Reserve documented this prior to the pandemic, revealing that many Americans would be unable to scrounge together $400 in an emergency. These long-existing crises of illiquidity only became widely apparent in the context of COVID-19.

But it did not used to be this way—at least not for so many. The last four decades have witnessed a steady “evacuation of the near future,” to use the language of anthropologist Jane Guyer. In a 2007 essay, Guyer compared the temporalities of her post-WWII childhood in Britain with those of the neoliberal era, relying on research she conducted in Nigeria, among other studies. She argued that mid-century life was structured by the logic of the economic plan, sequentially unfolding in five-year periods. Keynesian social democrats were committed to the state direction of investment and resource allocation according to regular timeframes. The U.K. welfare state that was built in the 1940s kept workers secure from medium-term fluctuations through social insurance and healthcare, while longer-term horizons were stabilized through pensions and social security. Industry, too, cultivated the near future. In the Unites States the 1950 Treaty of Detroit ended the annual strikes in the automobile industry, as UAW members received predictable wage increases, healthcare, and pensions. Working people could reliably plan for the future, with increased homeownership, the end of unemployment’s specter, and the guarantee of a solvent retirement. And, in turn, the Big Three automakers could plan for the near future without the risk of work interruptions.

Today stands in marked contrast. For many people the near future is uncertain and volatile. What was once the guarantee of a stable job has devolved into a hustle for gigs. The burdens of rent, debt, and other routine costs bear down on workers at a monthly pace, with the interim filled with the constant stress of having to work so as not to fall behind. Instead of imagining life as a series of successive stages—schooling, an advancing career, and retirement—downward mobility or stasis is the norm. But while this trend still seems novel in Euro-America, it was presaged in the post-colonies. In parts of the world where a welfare state and collective bargaining failed, such as Nigeria, there stands a long history of surviving in the face of an inescapable presentism.

While the mid-century division of the world into “developed” and “developing” countries suggests that the United States and Nigeria are economically incommensurate, especially if looking at annual income or GDP, this dichotomy is misleading. Instead, we should conceive of wealth and well-being around the world in relationship to the future: available for the well-off and relentlessly under question for the less fortunate.

Focusing solely on income inequality also misses how capitalist management exploits time. Many accounts—such as E.P. Thompson’s essay on time and work-discipline in industrial capitalism—emphasize how the consolidation of the working day wielded new control over the proletariat. But today it is not just the factory floor where value is extracted; instead it is taken from the spending of populations that remain forever on the brink of going broke. With the short-term expenses of renters and debtors serving as a reliable source of profit, decent wages are no longer a necessary compromise to buoy demand. As a result, firms are less incentivized to negotiate with and pay their workers.

Emma Park and I have called this the “zero balance economy”: an economic reality wherein volatility and empty wallets are the norm. This economy was routine throughout our research in Kenya, but it applies elsewhere. Whether in the piecework regime of popular economies or among waged workers with limited unionization, there is not enough collective power to render income sufficient and predictable enough to escape the dash from paycheck to paycheck.

But this experience of zero balance—the routine rhythm of insufficient funds—is not a phenomenon that occurs external to capitalism. Though a recent book on “wageless life” contends that systems of profit have “no such incentive to absorb” surplus populations “rendered economically redundant,” this is not the case. Rather, the zero balance economy reflects new techniques of exploiting labor, expropriating wealth, and appropriating time. We should conceptualize it as the colonization of our futures, controlled by external forces to extract as much as possible.

Regardless of whether participants in the zero balance economy are unwaged workers, irregularly employed, or simply make an insufficient income, they are sources of considerable profit. In the UK the growth of “zero-hours contracts”—where employees are not guaranteed any work yet are expected to appear at the firm’s convenience—gives employers flexibility to reduce their costs as they please. It is also surprisingly lucrative to sell to those who are frequently broke. For example, renting to those with recurrent evictions is extremely profitable.

In Kenya the most profitable company—the telecommunications and finance giant Safaricom—excels at business models designed for those with volatile incomes. Safaricom has also pioneered lending via phone, where loans arrive on individuals’ cellphones with just a few clicks. Safaricom’s products, such as M-Shwari and Fuliza, as well as apps from Silicon Valley firms such as Tala and Branch, have exploded in popularity in recent years. They are now crucial means for many Kenyans to meet their daily costs. One survey found that 67 percent of these borrowers use the loans for basic personal consumption—a figure driven by Kenya’s slowing pre-COVID-19 economy, as well as the country’s spiraling costs of food, healthcare, and education. But the cost of borrowing is punitive—sometimes boasting interest rates in the triple digits if annualized—and their short-term basis forces borrowers to scramble to avoid additional fees and defaulting. In this way, their closest comparisons might be payday lending, cheque cashing, or pawn shops.

This dynamic recalls Wolfgang Streeck’s argument that the retreat of public goods in Euro-America has led to an expansion in private household debt. Due to a combination of fiscal straight-jacketing, financial deregulation, and stagnant wages, people have turned to debt to finance decent standards of living, in effect mortgaging their future incomes to meet present, demanding needs. Debt is a crucial mode to “buy time,” but not all debt is created equally; minoritized persons, female-headed households, and low-income people struggle to access credit at a duration and price that actually works in their favor. Too often efforts to “financially include” working people—whether in Kenya, the United States, or elsewhere—take the form of what Keeanga-Yamahtta Taylor calls “predatory inclusion.” Short-term initiatives ultimately undermine long-term flourishing, not least because they do nothing to confront the discriminatory logic embedded in the market and in financial policies.

So, what can be done to build economies in which working people are not driven by the short-term capitalist dictates of rent, debt, and commodification? What kind of economy might allow working people to plan their own futures?

To begin, we should broaden the scope of contemporary progressivism, which too often looks solely to the North Atlantic for inspiration. Maintaining the late colonial conceits of “welfare for us” and “development for them” blinds Euro-Americans not only to the problems common across the globe, but also to the lessons that might be gained from other counties. Whatever insights the era of Keynesian capitalism might offer progressives today, we should not forget its limits. The political economy manifest in the Treaty of Detroit was racially exclusive, built on the backs of unwaged women, and premised on resource extraction from postcolonial settings; it offered little to those who imagined a life outside of waged work. Instead, it sought to prune the edges of industrial capitalism, securing retirement, vacation time, and a system of relief for those temporarily out of work on a temporary basis. For many, the call for a guaranteed basic income today is an extension of this logic.

We must move beyond the idea that economic justice can be achieved through redistribution, and instead move toward a conception of the economy that gives working people productive power. Appreciating the significance of controlling assets, not just income, might produce a more fulsome political imagination. Recall the exoduses from Delhi, Nairobi, and other postcolonial cities as COVID-19 spread and, with it, closures were announced. For many leaving was an act of desperation, but these departures drew on long-standing repertoires for managing uncertainty.

In Kenya, the context with which I am most familiar, urban workers remain committed to agrarian lands for both sacred and emotional reasons. But these enduring ties to the land also provide an important a material strategy. Where retirement accounts are rare and urban livelihoods volatile, owning a small farm—or contributing to the upkeep of a family plot—is economically sensible. A piece of land—mostly vegetables, perhaps some crops to market—offers a safety net that the state does not provide. As Lyn Ossome put it, “land forms the primary basis for social reproduction… [so even] as agriculture’s contribution to the GDP of most African countries has steadily declined, the relevance of land and landed resources, especially access to the commons, has continued to rise.” Owning land provides an escape from the commodified world of the city, rental housing, and privatized utilities. It does not depend on a redistributive system of taxes and welfare, rather it provides a productive asset that offers future security.

While we obviously shouldn’t expect a mass turn to farming among the office workers of Euro-America—and taking into account that demographic, ecological, and economic transformations strain the model around the world—we should consider what alternative types of property and assets might be created or redistributed. Projects that boost popular property ownership carry a bad reputation owing to their role in unmaking mid-century social democracy. Margaret Thatcher’s “popular capitalism,” for instance, undermined councils and public provisioning in the 1980s. More generally, the turn to wider shareholding obliges people to become entrepreneurs, yoked to financial shocks and subject to the market power and manipulations of large financiers.

But other forms of popular control over the economy exist: employee stock ownership schemes, worker cooperatives, and commons-based production. Popular control over assets, enterprises, and services can reverse the expropriation of the future. Whether through worker control, municipal socialism, or nationalization, democratic management should be extended beyond housing, healthcare, and education. Worker control and democratic direction of capital allocation, economic coordination, and production decisions will broaden the bases for planning. If done at a variety of scales—from the domestic to the firm, city, and state—far more people will be able to reliably navigate what comes their way, rather than remaining confined by urgent needs. Some of this should aim to account for historical racial oppression, such as proposals to provide specialized trusts to allocate necessary capital to repair and build lives and neighborhoods. Other approaches should be more generalized, such as proposals around the Green New Deal to bring energy utilities within collective authority so that their investments reflect public purpose rather than private gain. Under Jeremy Corbyn UK Labour explored similar models of alternative ownership, drawing on evidence of their productivity, stability, and decency for workers. This exemplified how public policy should encourage the extension of popular management, through providing funds for worker cooperative buyouts, shielding employee owned firms from private takeover, and reforming government procurement. Nascent proposals for ownership funds, such as those from Common Wealth in the UK, offer avenues for collective access to and control over wealth.

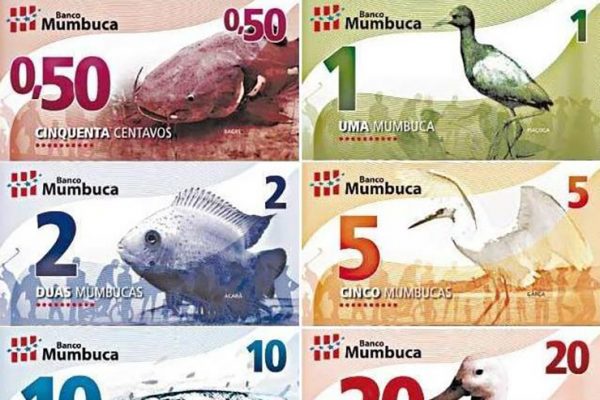

It will also be crucial to remake the credit system. The turn to “privatized Keynesianism,” which requires working people to smooth fluctuations in aggregate demand through private borrowing, has given debt a bad name. For-profit lending—including under the guise of “financial inclusion” and “microcredit”—inhibits people’s ability to securely plan for the future, as they are driven from one source of debt to another. Debt cancellation is a proper starting point to counter this. But as with productive assets, the credit system should be remade in the service of popular well-being.

For one, government lending programs should be remade to direct credit to people at a cost and duration that provides escape from the short-term extraction of wealth currently characteristic of contemporary housing, education, and other markets. Ending the dynamics of racial capitalism should be an explicit goal of left social movements and politics today. Mehrsa Baradaran and others emphasize that this can be done by allowing everyone access to safe and subsidized payment systems from the Federal Reserve, by using the Postal Service for free savings and checking accounts, and through the operation of public banks. State, regional, and national banks should make decisions about investment and lending in line with direct and representative democratic input, supported (like Wall Street currently is) by the sovereign money of the Federal Reserve, and tasked with supporting a Green New Deal and worker cooperatives. This would allow for projects chosen for their utility rather than profitability, while also providing stable employment, living wages, and access to assets.

This is something the Manchester silk weaver would have recognized: the need to mitigate urgent temporalities of labor through assets that can be stored and credit systems that allow working people to plan their futures.