Click through for a larger image. Illustration: Grace Van't Hof

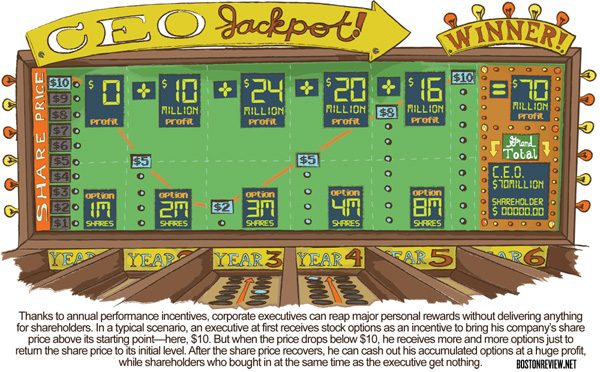

Click through for a larger image. Illustration: Grace Van't Hof

American corporate executives, we are regularly assured, are rewarded only when they perform. In reality, though, pay-for-performance has become a perpetual enrichment machine for the captains of business.

Executives don’t even have to game the system in order to gain their windfalls. The foundation upon which contemporary executive pay rests—the practice of granting large stock-related incentives on an annual basis—almost guarantees jackpots for top executives. By bestowing generous performance incentives year after year, corporate boards essentially reward executives for digging themselves out of whatever holes they dig themselves into.

Say a company’s stock loses value for the first few years after a new CEO takes over. Annual rewards make that loss irrelevant to the CEO’s future personal prosperity, since the new lower share price becomes the benchmark for measuring future successful performance. The CEO can then reap profits simply by returning the company’s share price to its original level.

If a company's stock loses value, the CEO can then reap profits simply by returning the company’s share price to its original level.

For instance, in 2007, the Goldman Sachs board gave the bank’s top executives options to purchase 3.5 million shares. Then came the meltdown. Goldman’s response: more options. In December 2008, with shares trading at record lows, the bank’s top execs received nearly 36 million stock options, ten times the previous year’s total. Thanks to Uncle Sam’s bailout, by January 2011, the share price had recovered and Goldman’s top 475 executives collected $2.7 billion in personal profits from options collected in 2008.

When Stephen O’Byrne of Shareholder Value Advisors examined the executive pay records of 2,618 companies from 1992 through 2008, he found 55,002 instances in which companies had granted executives options in three consecutive years. In 95 percent of these instances, the boards had varied the number of options from one year to the next, setting the stage for easy jackpots.

Eliminating this executive pay-for-performance scheme would be challenging, but its effects can be mitigated. One opportunity is on its way from the Securities and Exchange Commission, which will soon release long-delayed regulations that require corporations to annually disclose the ratio between their CEO and median worker compensation. With these regulations in place, we’ll have for the first time an official metric that defines the CEO-worker pay gap at individual corporations. Lawmakers will be able to attach consequences to these ratios. They could, for instance, deny government contracts to companies that compensate their executives above an acceptable ratio. Activists could mobilize consumer pressure against companies with unconscionably wide pay gaps. All this public and legislative weight could exert long-overdue downward pressure on CEO pay excess, whether from stock options or any other income stream.